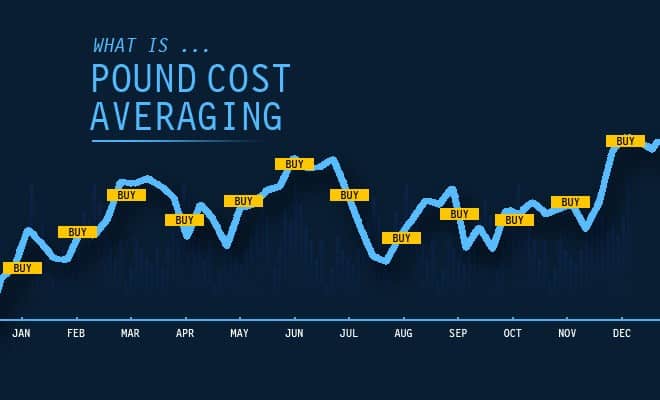

Pound cost averaging is the concept of drip feeding your cash into an underlying investment rather than investing in one larger lump sum. The concept is most typically cited when considering making an investment in the stock market via individual shares or funds.

The rationale for pound cost averaging is that equity markets can be volatile, which means the value of investments could fluctuate significantly in the short term. By drip feeding your cash into the markets, you are providing yourself with some protection in case the market falls shortly after you have invested. Of course, the problem is that the shares generally rise over time, and so if you decide to hold off investing a lump sum and end up investing at increasing prices, your returns will be lower than if you had invested the full lump sum.

Worked examples of pound cost averaging

Taking the FTSE 100 as an example (chart below), you will see that there have been multiple corrections over the years.

Lets imagine we had £60,000 available to invest on 1 January 2002, and 1 January 2009.

Falling market

On 1 January 2002, the FTSE 100 index was tracking at 5264.8. Whilst you can’t buy shares in the FTSE 100 directly, we will imagine that this is an ETF tracking the index. A £60,000 investment made on 1 January 2002 would have fallen in value to £45,776 by 1 December 2002. However, if we had invested £5,000 each month, our acquisition cost would have averaged down to 4565.8, meaning our investment would instead be worth £51,761 (£6005 more than if we had made a lump sum investment). This example shows that using pound cost averaging would be advantageous in a falling market.

| Date | FTSE 100 (pence) |

|---|---|

| Jan 01, 2002 | 5164.8 |

| Feb 01, 2002 | 5101 |

| Mar 01, 2002 | 5271.8 |

| Apr 01, 2002 | 5165.6 |

| May 01, 2002 | 5085.1 |

| Jun 01, 2002 | 4656.4 |

| Jul 01, 2002 | 4246.2 |

| Aug 01, 2002 | 4227.3 |

| Sep 01, 2002 | 3721.8 |

| Oct 01, 2002 | 4039.7 |

| Nov 01, 2002 | 4169.4 |

| Dec 01, 2002 | 3940.4 |

| Average | 4565.8 |

Rising market

On 1 January 2009, the FTSE 100 index was tracking at 4149.6. Again, we will imagine that this is an ETF tracking the index. A £60,000 investment made on 1 January 2009 would have increased in value to £78,266 by 1 December 2009. However, if we had invested £5,000 each month, our acquisition cost would have averaged up to 4593.0, meaning our investment would instead be worth £70,710 (£7556 less than if we had made a lump sum investment). This example shows that using pound cost averaging would be disadvantageous in a rising market.

| Date | FTSE 100 (p) |

|---|---|

| Jan 01, 2009 | 4149.6 |

| Feb 01, 2009 | 3830.1 |

| Mar 01, 2009 | 3926.1 |

| Apr 01, 2009 | 4243.7 |

| May 01, 2009 | 4417.9 |

| Jun 01, 2009 | 4249.2 |

| Jul 01, 2009 | 4608.4 |

| Aug 01, 2009 | 4908.9 |

| Sep 01, 2009 | 5133.9 |

| Oct 01, 2009 | 5044.6 |

| Nov 01, 2009 | 5190.7 |

| Dec 01, 2009 | 5412.9 |

| Average | 4593.0 |

What to consider before pound cost averaging

Major equity markets have historically risen more often than they have fallen. Therefore, if you do not have a lump sum of cash and are considering starting to drip feed money into the stock market, then this is a tried and tested methodology of generating wealth over the long term.

However, if you have not invested before or have suddenly come into a lump sum of money, you may be wondering whether it is sensible to invest all of your funds into the stock market in one go given markets can be volatile.

Ultimately, investors with this dilemma should step back and ask themselves which of these scenarios they would feel more comfortable about:

- Making a lump sum investment and then seeing stock markets fall resulting in a 15% decrease in your investment value.

- Drip-feeding your investment and then seeing stock markets rise in value by 15%, but due to utilising the pound cost averaging method, your investment gains are only 6%.

Pound cost averaging is best thought of as insurance which comes at a price. If you are particularly fearful of a market correction/downturn, you may come to the conclusion that the cost of pound cost averaging is a price worth paying for insurance against regret.