What are share options?

Share options are a type of financial security. When investing in share options, you are purchasing a contract which gives you the right (but not obligation) to buy or sell a certain number of shares at a fixed price either at any time before the option expires. Investors pay a premium for this right.

Option contracts can also be taken out on other markets such as bonds, commodities, forex markets and stock market indices.

How do share options work?

There are two types of share options – call options (a contract to buy shares at a stated ‘strike’ price) and put options (a contract to sell shares at a stated ‘strike’ price). It’s important to remember that whenever you acquire an option, there is another party (known as the writer) on the other side of the trade.

| Type of share option bought | Share price moves above strike price | Share price moves below strike price |

|---|---|---|

| Call option (option to buy) | Let option expire (lose premium paid to acquire the call option) | Exercise call option to generate profit |

| Put option (option to sell) | Exercise put option to generate profit | Let option expire (lose premium paid to acquire the put option) |

| Type of share option sold | Share price moves above strike price | Share price moves below strike price |

|---|---|---|

| Call option (option to buy) | Profit generated from premium | Loss incurred (equal to the buyers profit) |

| Put option (option to sell) | Loss incurred (equal to the buyers profit) | Profit generated from premium |

Purchasing call options

If you are bullish about a shares prospects, you may wish to purchase a call option. This gives you the right (but not the obligation) to purchase an underlying security at a fixed price (known as the ‘strike’ price) on or before a set date. When you purchase a call option, you pay an initial ‘premium’. It is not possible to lose any more than this premium if you decide not to exercise your option.

If the market value of the share rises above the strike price before the set date, you can opt to exercise your option to purchase at less than the market price. If the market value of the share falls, you can opt against exercising your option. In this scenario, you would lose the initial premium you paid to acquire the call option.

Selling call options

When you buy a call option, your downside risk is limited to the price you pay as an option premium. However, when you sell a call option, your downside risk is significantly higher. The loss incurred by the seller of the call option will be equal to the profit of the buyer. Conversely, the maximum profit that can be generated from selling call options is the option premium paid by the purchaser of the call option.

Purchasing put options

If you are bearish about a shares prospects, you may wish to purchase a put option. This gives you the right (but not the obligation) to sell the share at a fixed price (known as the ‘strike’ price) on or before a set date. When you purchase a put option, you pay an initial ‘premium’. It is not possible to lose any more than this premium if you decide not to exercise your option.

If the market value of the share falls below the strike price before the set date, you can opt to exercise your option to sell at more than the market price. If the market value of the share rises, you can opt against exercising your option. In this scenario, you would lose the initial premium you paid to acquire the put option.

Selling put options

When you buy a put option, your downside risk is limited to the price you pay as an option premium. However, when you sell a put option, your downside risk is significantly higher. The loss incurred by the seller of the put option will be equal to the profit of the buyer. Conversely, the maximum profit that can be generated from selling put options is the option premium paid by the purchaser of the put option.

Why are share options used?

Share options are either purchased as a hedging tool by existing shareholders or as a speculative investment.

Options as a hedging tool

An existing shareholder may wish to retain their long-term interest in a particular company, but have concerns over the short-term share price. In this scenario, the investor may purchase put options so that they will profit if the share does decline in price below a certain strike price. If the share does drop below the strike price, the shareholder will suffer further capital loss in their shareholdings but will make a gain on the put option.

Options as a speculative investment

Investors can speculate on shares they believe will:

- Rise in price by buying call options or selling put options

- Fall in price by buying put options or selling call options

How to invest in share options?

The Intercontinental Exchange (or ‘ICE’) is an American company which owns futures exchanges in the US, Canada and Europe. The ICE Futures Europe market is home to futures and options contracts for crude oil, interest rates, equity derivatives, natural gas, power, coal, emissions and soft commodities. Single share options can be viewed here.

By clicking on some individual companies such as Astrazeneca or Imperial Brands, we can see that the standard unit of trading is 1,000 shares. This means that one option grants the right (but not obligation) to acquire 1,000 shares in either of those companies. At the time of writing, Astrazeneca is trading at £79.84 per share, whilst Imperial Brands is trading at £15.78. This means that 1,000 shares of each would cost £79,840 and £15,780 respectively.

If you would like to invest in share options on the ICE Futures Europe market, you will need to do so via a member broker. A full list of ICE members can be found here. All share option purchases attract a stamp duty charge (0.5% of the total purchase cost).

Investing in share options is not particularly accessible for private investors in the UK, though other derivative instruments that allow you to speculate on the price movement of shares and other securities are readily available in the form of CFDs and spread betting. When trading CFDs or spread betting, you never take ownership of the underlying shares and thus do not pay stamp duty.

It’s important to note that trading in derivative products such as share options, CFDs and spread betting is typically unsuitable for most private investors. You have to be an active investor who follows share prices throughout the day, every day. If you do not have this time available to commit, you would be better served looking at alternative investment options.

How are share options priced?

Option prices are impacted by several factors, with the overriding driver being how likely the option is to become profitable. Factors impacting this profitability are outlined below:

- Current share price / strike price – If you purchase a call option to buy at a certain strike price, that call option will be worth more as the share price rises higher. Conversely, it would have a negative impact on the value of a put option.

- Time to expiration – Options have a limited lifespan. As time passes, an options price will reduce if it looks increasingly likely that the option will not become profitable.

- Dividend payments – Dividend payments reduce share prices as they represent a capital outflow from the company. Share options do not benefit from dividend payments as they give the holder a contractual right to buy shares at a fixed price, not current ownership of a share. Therefore, a fall in the share price will negatively impact a call options value and positively impact a put options value.

- Volatility – If the share price of a particular company is particularly volatile, it increases the likelihood that the option will at some point become in-the-money.

- Type of option – Share price rises will positively impact the value of call options, but will negatively impact the value of put options.

- Interest rates – Interest rates have a minimal effect on options price. Conceptually, when interest rates increase, call option prices increase and put option prices decrease. This is because call options become slightly more attractive than equity holdings to investors who are bullish about a particular share because the uninvested cash would generate a higher return in safer investments such as government bonds.

To view live options pricing data, you need to be an active participant and member of the ICE Futures Europe market. However, historical end of day pricing reports for options trading on the market can be freely downloaded here.

Share options pricing example using Imperial Brands

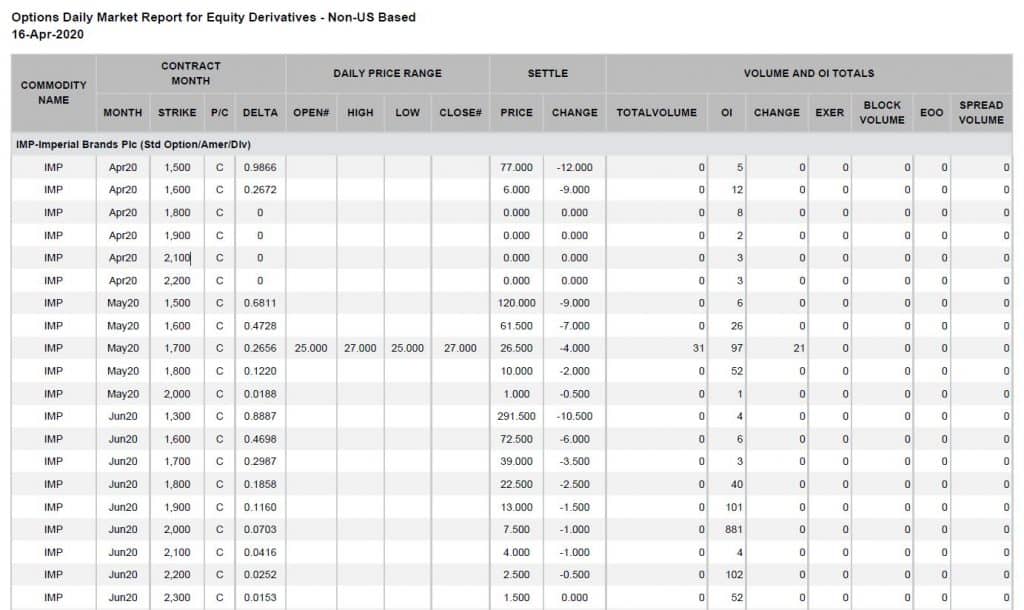

An example daily market report for Imperial Brands is shown below:

Key for the terms used in the share options report shown above:

- Month – The expiry date of the option.

- Strike – The fixed price at which the holder of the call/put option has the option to purchase shares at.

- P/C – Denotes whether the line item refers to a put (‘P’) or call (‘C’) option.

- Delta – The delta ratio compares the change in the price of the Imperial Brands share price with the change in the price of the option. The delta for a call option always ranges between 0 and 1, whilst the delta for a put option always ranges between -1 and 0.

- Daily price range – Refers to the daily price range of options traded in the day. For this reason, the data is only shown on the line item where there has been transaction volume during the day.

- Settle (price) – The settlement price is used to mark the value of open options contracts.

- Settle (change) – The daily change in the settlement price.

- Total volume – The number of options contracts exchanged between buyers and sellers during the day.

- OI – The number of options contracts held by traders and investors in active positions.

- Exer – The number of options contracts exercised during the day.

- Block volume – A block trade is simply a large transaction of multiple contracts which is reported separately. The block trade minimum on Imperial Brands options is 100 contracts. The report generated for 16 April 2020 featured no block trade volume.

- EOO – An exchange of options for options. This refers to a privately negotiated trade involving the exchange of a futures contract (traded on an exchange) for an over the counter (OTC) contract (not traded on an exchange, bespoke contracts) option involving the same underlying asset. The report generated for 16 April 2020 featured no EOO volume.

In the screenshot shown, we can see that 31 call options were purchased on 16 April 2020 with a strike price of 1,700 and an option expiry date of May 2020. The expiry date of May 2020 means that the last trading day on which the option can be exercised is 15 May 2020 (the third Friday in May). We can see that the price of this option ranged between 25 (£0.25) and 27 (£0.27) per share. Given that one option normally equals 1,000 shares, the total price of one of these options would have been £250 if the price of £0.25 was obtained (£0.25 * 1,000 = £250). This option premium is payable at the point of purchasing the call option. On top of the option premium, stamp duty of 0.5% and broker fees would be payable on the transaction. For simplicity, we will ignore these fees in our worked example.

The current share price of Imperial Brands is 1563 (£15.63) on 17 April 2020. The call option we are looking at is therefore currently out-of-the-money, meaning it would not currently make financial sense to exercise the contract. If between 17 April 2020 and 15 May 2020, the Imperial Brands share price remains at a similar level, the purchaser of the share option will lose all of his/her initial £250 premium.

However, if the share price rose to 1750 (£17.50) before the last trading day, the call option would be described as being in-the-money. Exercising the option to acquire the shares at this stage would drive a profit upon resale. As one option contract gives the right to acquire 1,000 shares, this level of proceeds generated would be £500, generating a healthy £250 profit.

| Transaction | £ |

|---|---|

| Option exercised - 1,000 shares purchased at 1,700 (£17.00) each. | £(17,000) |

| Shares sold - 1,000 shares sold at 1750 (£17.50) each | £17,500 |

| Proceeds generated | £500 |

| Less initial option premium | £(250) |

| Profit generated | £250 |