A prepayment is commonly defined as an expense which has been paid in advance of its due date. As cash has been paid up front, this represents an asset on the balance sheet. It is an asset because a benefit is expected to be received in respect of this in a later period.

This concept only exists under the accruals basis of accounting (i.e. where revenue and expenses are aligned to the period to which they relate). Under cash accounting, expenses are fully recorded in the period where the cash payment is made and thus prepayments are never recorded.

In practice, prepayments are often bundled together with ‘other debtors’ in management accounts. Other debtors are balances owed to the company for matters not relating to trading. For instance, a deposit on rental property or equipment.

It is also worth noting that within other debtors and prepayments, there can often be balances which the business has not yet prepaid. This occurs where an invoice is received for services due to occur in the future where the balance is not yet due. Management may wish to record the trade creditor in management accounts when the invoice is received, but will not wish to settle the balance until it is due. As such, a trade creditor is recorded with a corresponding asset balance which will sit within ‘prepayments and other debtors’.

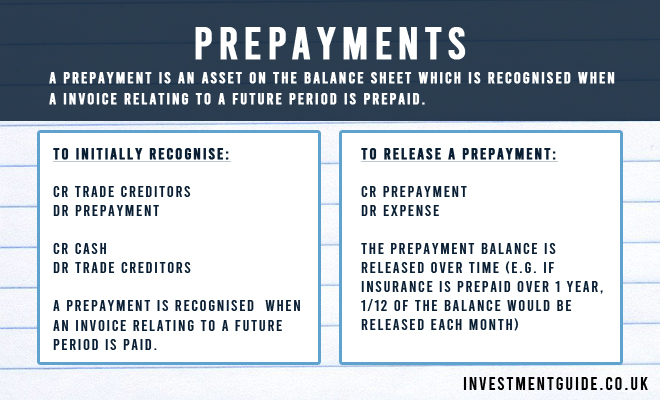

Prepayment double entry

At 31 Dec 20X1 (year-end), an annual invoice is received from a software supplier for FYX2. None of this expense relates to FYX1. As such, the first double entry we record is:

- Cr Trade Creditors £1,200

- Dr Prepayment £1,200 (Note: It is also possible to post Cr Trade Creditors and Dr Expense initially, and then Dr Prepayment Cr Expense. We have skipped a step here by posting directly to prepayments)

When the payment is made, our cash balance will reduce by £1,200 and the trade creditor balance is eliminated. If this balance had not been paid, both the trade creditor and trade debtor balances would remain at 31 Dec 20X1.

- Cr Cash £1,200

- Dr Trade creditors £1,200

At the end of January 20X2, the prepayment should be wound down by 1/12 as one month of the subscription has passed.

- Cr Prepayment £100

- Dr Expense £100

Common examples of prepayment balances

Some common examples of balances seen within prepayments are:

- Rent/lease payments – Often paid monthly or quarterly in advance.

- Rates – Similarly, often paid in advance. However, in the UK, rates invoices are typically not prepaid in full as the council sends an invoice for business rates for the full year despite rates only being due on a monthly basis. As a result, most businesses record a prepayment for the full value (Dr Prepayments, Cr Trade Creditors for the full value) and then unwind as the cash is paid (Cr Cash, Dr Trade Creditors) and as time passes (Cr Prepayments, Dr P&L expense).

- Utility bills

- Insurance payments – Often paid annually in advance.

- Deposit for a rental property (though this is typically regarded as an ‘other debtor’)

Analysis on prepayments

In a financial due diligence process, analysts will typically request and present a breakdown of the prepayments balance in order to understand the key components.

The main things to consider when analysing prepayments are:

- What are the key components and are they likely to re-occur going forwards or are they one-off in nature?

- Has Management accounted for the prepayment balances correctly?

- Are there are any non-trading balances hidden within prepayments? One example of a of non-trading item seen within prepayments is a prepayment for loan arrangement fees.

These are the key considerations as the purpose of understanding the prepayments balance is to understand whether any adjustments need to be made to working capital (both at year-end and across the target period e.g. last twelve months).

Forecast considerations for prepayments

How you forecast prepayments is totally dependent upon the key components of the prepayments balance which varies from business to business.

When analysing the methodology utilised by Management as part of a financial due diligence exercise, analysts will compare the total prepayments balance in each forecast period vs. the historical period and present a number of KPIs (e.g. maximum, minimum, range and average across each forecast period, prepayments as a % of non-salary costs, prepayments as a % of trade and other debtors balance). These metrics will be discussed with Management in order to understand the key drivers of any change going forward.