Are you intrigued to learn more about fine wine investment?

Perhaps you are actively considering investing in fine wine?

Either way, this ‘investing in wine’ guide will seek to meet your needs by giving you all of the information you need to get started on your wine education or investment journey.

Investing in wine

Passion vs. investment

You may love wine. Drinking it, smelling it, tasting it, enjoying it with friends. That’s great and I do too, but it’s important to ensure that a love of wine does not cloud your judgement when considering fine wine as a prospective investment.

Remember that before making an investment in fine wine, you won’t have the chance to personally taste your potential investments and you shouldn’t actually take physical possession upon purchase either. Instead, your wine purchases should be kept ‘in bond’ in a HMRC-approved wine storage facility. This approach ensures that your purchases will be free of duty and VAT (as the wine is essentially stored ‘in transit’), with any profits on sale remaining free of capital gains tax. Further, it will provide any prospective future buyers with greater confidence that the wine has been kept in good condition.

What makes a fine wine appropriate for investment?

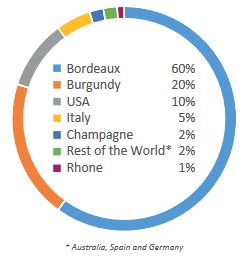

Great tasting wine is produced in regions all across the world, but a great taste does not make a wine suitable for investment. France is home to the largest proportion of investment grade wines. The below graphic (from Cult Wines, using data from Liv-ex) illustrates the proportion of the worlds investment grade wines from various regions.

In addition to the region a wine is from, a number of other factors impact the investment value of a particular fine wine.

What factors impact the value of fine wine?

Fine wine is a passion asset. It holds its value because wealthy wine enthusiasts and connoisseurs want to own and enjoy wine as one of the finer things in life. Fine wine prices are therefore purely a function of supply and demand. The key drivers are listed below.

Demand drivers

- The prestige of the producer – How well regarded the producer is has a significant impact on price and demand. For example, bottles from Chateau Lafite Rothschild are among the most expensive in the world.

- The region of the producer – The French regions of Bordeaux and Burgundy dominate the wine investment landscape. Wine markets in other countries can present higher levels of investment risk due to being less established.

- How long the producer has been in business – Where a producer has a long history of success in producing quality fine wines which hold their investment value, higher demand for their wine will drive up prices.

- Quality of the vintage – A vintage refers to the year grapes were harvested to produce the wine. The quality of wine produced is impacted by changing weather conditions and micro climate in the region. Wines from better vintages command higher resale prices and increase the ageing potential of the wine.

- Stage in life cycle (En Primeur, secondary market) – Buying a wine En Primeur means buying it whilst the wine is still in its barrel before it is bottled and released to the open market. Buying En Primeur can be notably cheaper than buying on the secondary market once the wine has been bottled. However, there are additional risks associated with buying a product which is not yet ready to be bottled.

- Quantity and condition of wine – Except in the case of particularly rare bottles, collectors and investors tend to prefer purchasing cases of wine rather than singular units. For this reason, it is typically better to acquire wines by the case.

- Market trends – For example, wines from a particular region may receive media coverage driving a potentially short-term increase in consumer demand.

- Critic ratings and scheduled re-scores – Critic ratings can have a profound impact on the price and market demand for fine wines. For example, a high score from Robert Parker’s Wine Advocate (now owned by the Michelin Guide) can significantly move wine prices.

Supply drivers

- How many cases are produced – Rarity adds value to fine wine because limited supply drives up prices as willing buyers will find there are fewer willing sellers.

- Age of the wine – As time passes, the supply of particular fine wines is likely to diminish as wealthy wine enthusiasts acquire and drink them. This reduction in supply is likely to increase prices.

- Macro economic factors – The wine market is not insusceptible to macro economic blips. Past recessions have resulted in increased supply as wine investors seek to liquidate their wine investments, which in turn then resulted in decreased wine prices.

How to make money investing in wine

Fine wine will not pay a dividend, and there is no potential to generate any other income during the period of your ownership. You should only invest in fine wine where you believe there is strong potential to generate a capital gain after holding it for a number of years. This capital gain needs to be large enough to warrant the expense of the initial purchase and the costs of storing the wine throughout your period of ownership (which is often between five and ten years). Additionally, the condition and labels for wine bottles can play a crucial role in maintaining the investment’s value, as collectors and buyers prioritize authenticity and pristine presentation.

The initial cost for investment grade wine will range from £200 to tens of thousands of pounds. It’s important to remember that at lower purchase values, the cost of storage will represent a higher proportion of the initial cost. This means that the value of your wine will need to increase by a higher percentage in order to generate a capital gain.

In addition to purchase and storage costs, you may also need to factor in the cost of using a broker’s services to sell your investment (typically 10-15% of the sale price).

Is fine wine a stable investment?

Fine wine as an investment asset has performed remarkably well over the years. However, just as some individual investors have lost money over the years dabbling in the stock market despite overall market growth, some private wine investors will have suffered similar fates.

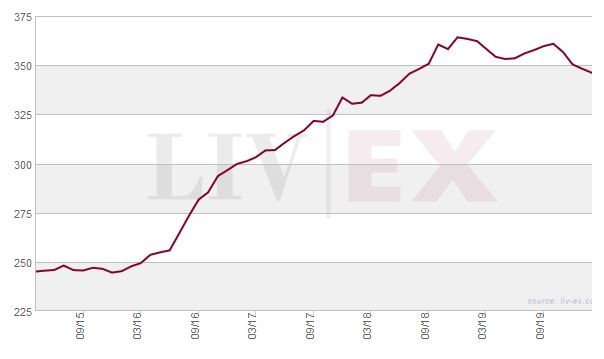

Liv-ex is the industry standard, trade-only global marketplace for wine. It provides the most comprehensive database of price data for the wine industry, with hundreds of millions of historical transactional price points to draw upon. With this data, it produces several indices (think FTSE 100 but for the wine industry) tracking the price of various wines listed on its marketplace.

The broadest index is the Liv-ex Fine Wine 1000 which tracks the pricing of 1,000 wines across the world. This index only includes wines with a regular market on Liv-ex, which are physically available in the UK market (i.e. excluding En Primeur wines). Between December 2015 and December 2019, the market index rose from 245 to 348 (9.17% compound annual growth).

Other major Liv-ex indices focus on the Bordeaux first growths, the top 100 fine wines and the 500 top wines solely from the Bordeaux region. In addition, there are a number of other regional indices, tracking regions such as Champagne, Rhone, Italy and the rest of the world.

Unlike the stock market, where you can acquire shares in tracker funds or ETFs which track the performance of a particular market index, no such product exists in the wine industry. Wine investment funds are the closest option, but minimum investment levels often mean that many smaller private investors will have to make personal investments in smaller quantities of wine instead. This lack of diversification enhances risk as a fall in value in one of your wines would have a greater impact on the overall value of your investment.

That being said, if you make the right choices, there is certainly money to be made by investing in fine wine. The general rule of thumb is never to invest money that you can’t afford to lose and to consider your wine investment as part of a wider diversified portfolio.

How to start investing in wine

Which wine investments are available to you as a private investor will depend on the level of cash you have available to invest. Various options for wine investment are discussed in turn below:

Investing in wine investment funds

The Wine Investment Fund – With a minimum investment of £10,000, you can invest with the Wine Investment Fund. The fund pools investor capital to invest solely in Bordeaux wines, citing reduced investment risk due to a strong recorded price history and liquid secondary market.

Investing via wine marketplaces / portfolio managers

Cult Wines – Cult Wines is the market leader in fine wine investment services. The company boasts having over £120 million of fine wine assets under management and offers investors the choice between an execution only wine investment platform or active portfolio management. Execution only services require a minimum £10,000 investment whereas portfolio management is reserved for those with over £25,000 to invest.

Liv-ex (trade only) – Liv-ex is a trade-only wine marketplace with a subscription membership model. Only approved trade members can purchase wine via Liv-ex, making it inaccessible to private investors.

BI Fine Wine & Spirits Merchant – BI’s LiveTrade platform is another online wine marketplace which features transparent two-way pricing for every wine listed on the platform (i.e. every wine features both a buy and sell price). There is no minimum investment – investment grade wine is available at various price levels.

Investing with wine merchants

Berry Bros & Rudd – Berry Bros & Rudd is a well regarded London based wine merchant, which offers a popular ‘Cellar Plan’ in which you can invest in fine wine from £100 per month, though a minimum of £250 is advised. Investors are assigned an Account Manager to help plan wine investments and any purchased wines can be stored in the companies own bonded warehouses.

Lea and Sandeman – Lea and Sandeman are another London based wine merchant, who offer a similar cellar plan to Berry Bros & Rudd with monthly contributions starting from £100 per month.

Wine auctions

A number of traditional auction houses such as Sothebys and Christies provide wine auctions, as well as specialist online auctioneers such as BidForWine. Smaller investors are generally advised not to purchase via online auctions as auctioneers may be less able to certify or guarantee the authenticity of the wine and how it has been stored. Bear in mind that you will likely be bidding against professional wine investors with more experience and knowledge of resale prices. If you are intent on buying at auction, ensure that you do lots of research beforehand, set a maximum price in your head to avoid auction fever, and pre-plan how you intend to store and transport your wine post-auction.

Wine in bond

There are many bonded warehouse facilities in the UK. Think of these companies as custodians of your wine, who are able to provide temperature controlled conditions to keep your wine as fresh as possible.

It’s important to use a HMRC-approved bonded warehouse to store your fine wine, as this is the best way to ensure the traceability and provenance of your wines. If you are investing via a wine merchant cellar plan, it is likely that your merchant will have their own recommended bonded warehouse facilities. However, if buying via a wine marketplace, you may need or want to find your own bonded warehouse facility.

Example pricing for HMRC-approved bonded warehouse storage

| Company | Warehouse location | Pricing | Other fees |

|---|---|---|---|

| Arc Wine Reserves | Great Shelford, Cambridge | Cases 1 to 24 – £8.00 Cases 25 above – £7.00 | One off reception fee of up to £3.50 per case. |

| Corsham, Wiltshire | £18.40 (minimum storage of 6 cases) | ||

| Houndmills, Basingstoke | £12.00 or £10.20 for members | ||

| Woodbridge, Suffolk | £7.30 |

What are the risks of investing in wine?

Whilst investments in fine wine can (and have) delivered solid long-term returns for investors in the past, past performance is no guarantee of future results. The key risks you should consider before investing in fine wine are:

- Illiquidity – Fine wine investments are illiquid. Cashing out of your investment will depend on there being demand from investors, wine enthusiasts or collectors to buy your fine wine. This risk can be reduced by investing in wines with strong history of demand.

- Unregulated market – Wine funds and portfolio managers are not subject to regulation. This increases the need for investor due diligence and the importance of dealing with reputable institutions which have been around for a number of years.

- Incorrect valuations – Private investors should ideally request valuations from merchants who are members of Liv-ex, as it is generally regarded as the most representative source of pricing information for the wine industry.

- Counterfeit wines – As with other luxury tangible assets, a risk of counterfeiting exists. Before making an investment in fine wine, private investors should speak with their chosen wine marketplace, portfolio manager, fund or merchant to understand what actions they take to protect against the risk of counterfeiting.

- Short-term market trends – Certain wines may experience waves of demand driven by media attention, for example. Rather than attempting to ride a short-term wave, private investors should view fine wine as a mid to long-term investment and focus on wines with a strong track record of performance.