Whereas silver and gold bullion coins and bars have illustrious pasts serving as legal tender across many economies, platinum has only ever been used within the monetary system of Russia. This is perhaps best explained by the fact that platinum was discovered by modern society far later and is much rarer than both gold and silver.

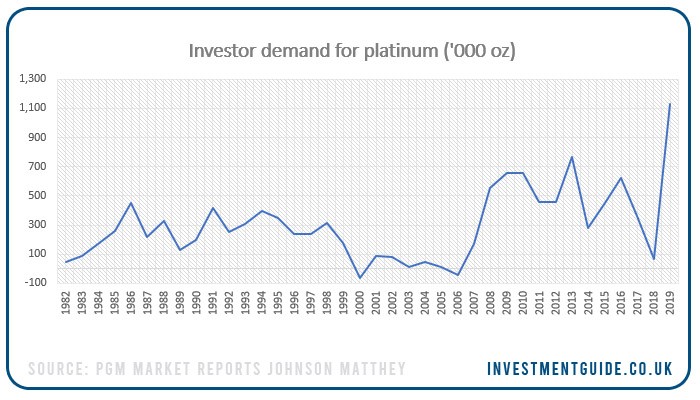

As a result, the investment market for platinum is far less established than the markets for gold or silver. However, demand for investing in platinum has certainly grown over the last few years, reaching a peak of 1.1 million oz in 2019.

Carry on reading to understand what gives platinum its value, where its mined, and how recent supply and demand trends have impacted platinum prices. Finally, we will summarise the various ways you can invest to gain exposure to the platinum market.

- What is platinum used for?

- Where is platinum mined?

- Platinum supply vs. demand

- Historical platinum prices

- How to invest in platinum

What is platinum used for?

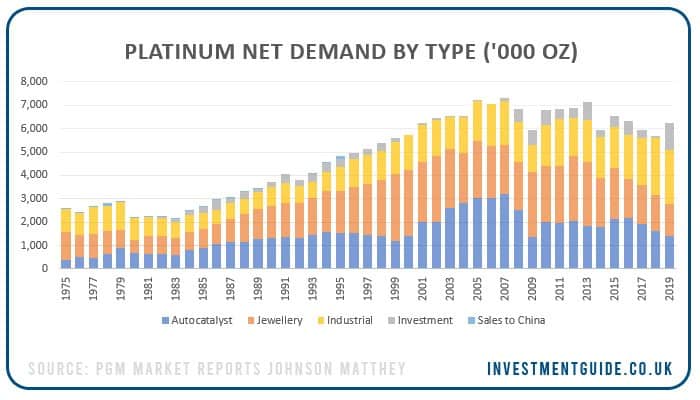

The demand for platinum is primarily driven by autocatalyst production (22.5% in 2019), the creation of jewellery (22.1% in 2019) and various industrial applications (37.2% combined in 2019). Demand linked to investment represented just 18.1% of the total in 2019.

Platinum use in autocatalysts

Autocatalysts are fitted to over 95.0% of all vehicles sold globally. An autocatalyst effectively acts to significantly reduce the pollutants (carbon monoxide, nitrogen, hydrocarbons, particulate) in exhaust emissions.

Increased demand over the years has been driven by an increased global focus on reducing harmful emissions.

Platinum use in jewellery

After autocatalysts, jewellery is the second largest driver of platinum demand. Platinum is regarded as a premium material in jewellery making, renowned for its strength and resistance to tarnish. These characteristics make it a particularly popular material in the creation of rings.

This wasn’t always the case – platinum use in jewellery has grown to become increasingly popular in the last 60 years. Japan initially started the trend in the 1960s, with different parts of Europe following suit between the 1970s and 1990s and Chinese popularity surging in the late 1990s. More recently, demand has begun to grow throughout India.

Industrial uses for platinum

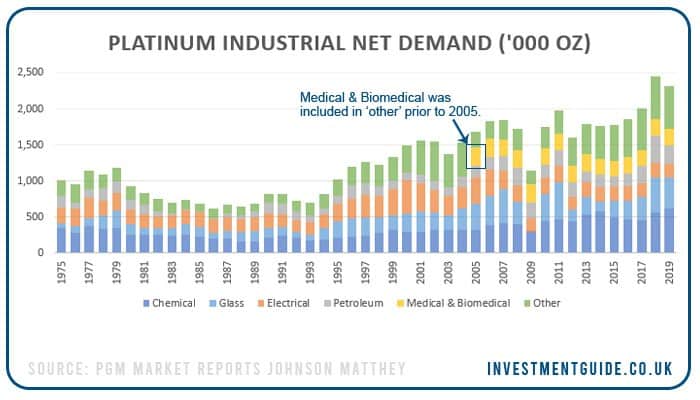

Demand for platinum for industrial use has increased from 0.7 million oz in 1993 to 2.3 million in 2019.

- Chemical – Platinum catalysts are used to improve the efficiency of various reactions. For instance, platinum is required to manufacture nitric acid.

- Glass – Platinum is used in the creation of vessels which hold, channel and form molten glass.

- Electrical – Platinum is used in a variety of electrical applications as a result of its conductivity and durability.

- Petroleum – Platinum is a key component in the production of gasoline.

- Medical and biomedical – Platinum is used to create certain complex components in pacemakers. You may also be surprised to learn that platinum is actually used in a variety of anti-cancer drugs.

Where is platinum mined?

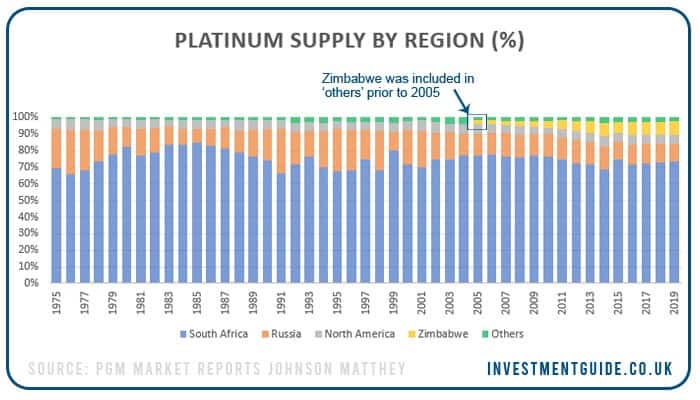

The vast majority of the worlds platinum is mined in South Africa (73.3% in 2019) and Russia (11.1% in 2019).

Mining platinum group metals (of which platinum itself is one) is both a labour and capital intensive process. The Bushveld Igneous Complex in South Africa and the Ural Mountains in Russia are two of the few places around the world which contain platinum group metals in quantities sufficient to justify funding the extraction process. The fact that there are so few places where platinum can be profitably mined in large volumes acts to restrict supply, which may continue to drive platinum prices higher if demand trends continue in the future.

Platinum supply vs. demand

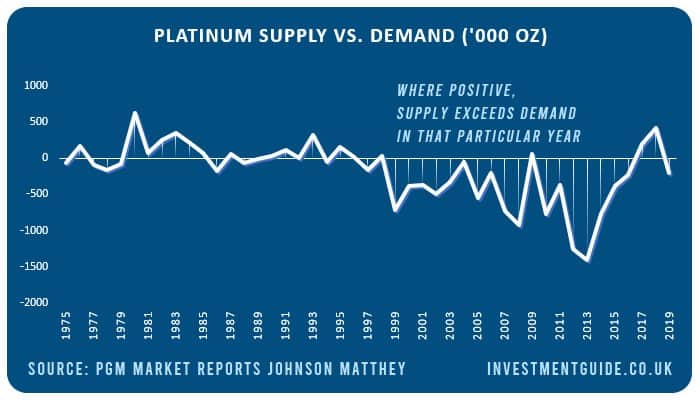

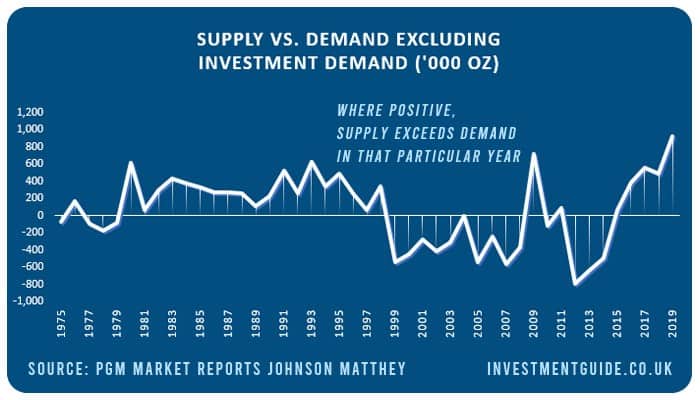

The chart below shows that demand for platinum has outstripped supply in all but two of the last twenty years.

Interestingly though, if we exclude investment demand, supply began to outstrip demand from 2015 onward. This suggests that unless investor demand is sustained, 2020 may see a return of platinum supply outstripping demand.

Historical platinum prices

Courtesy of Bullion Vault, see how the price of platinum has fluctuated over time. We have set the chart to show price movements (per oz) over the last 5 years as default but data is available for the last 20 years.

{{CODEBullionVault}}

How to invest in platinum

There are multiple options for investing in platinum or gaining exposure to platinum prices as part of your wider investment portfolio.

- Investing in physical platinum

- Investing in platinum mining companies

- Investing in platinum ETCs

- Platinum CFDs

Investing in physical platinum

If you are looking to acquire physical platinum as a private investor, the two most popular options available are buying directly from the Royal Mint or the Bullion Vault. Both options allow you to buy and store platinum safely in secure storage facilities, though The Royal Mint also provides the additional option of storing your platinum investment at home.

Royal Mint Bullion

Physical platinum can be purchased directly from The Royal Mint which is owned by Her Majesty’s Treasury. The Royal Mint sells both platinum bullion bars and limited release platinum bullion coins for collectors. When you invest in platinum through The Royal Mint, you acquire specific platinum bullion bars or coins.

- Platinum bullion bars – Available in 1oz (28.3g), 100g, 500g, 1kg weights.

- Platinum bullion coins – Multiple limited edition 1oz platinum bullion coins are available at any given time. These coins are sold at a slight premium to bullion bars of the equivalent weight.

When purchasing platinum from The Royal Mint, you can opt to take physical possession of the platinum to store at home or you can store it in ‘The Vault’ which is The Royal Mint’s purpose built previous metal storage facility. By storing with The Vault, you can be assured of the safety of your investment as the facility boasts state-of-the-art security systems and 24/7 on-site security. An annual fee of 1.0% (plus VAT) based on the value of the platinum bullion you store is charged to use this facility.

Be aware that buying platinum from The Royal Mint is not the most cost-efficient way of investing in platinum. However, for investors who are concerned about security and have more faith ordering directly from the treasury, it is certainly an option to consider.

When it comes to selling your platinum, you can either find a willing buyer on the open market or you can sell it back to The Royal Mint. However, be aware that if you do choose to sell it back to The Royal Mint in the short term, you are likely to make a loss as a wide spread is operated between buy and sell prices. Whilst platinum prices change frequently, the spread between buy and sell prices is likely to remain broadly comparable. At the time of writing, buy/sell prices were as follows:

| Platinum bars | Buy price | Sell price |

|---|---|---|

| 1oz (28.3g) | £722.19 | £556.02 |

| 100g | £2,283.89 | £1,786.20 |

| 500g | £11,223.90 | £8,930.98 |

| 1kg | £22,254.99 | £17,861.96 |

If you are buying multiple bullion bars/coins, bulk purchase discounts are available directly through The Royal Mint website. When buying platinum bullion bars, you pay VAT on the purchase. This is because platinum is classed as an ‘industrial’ metal like silver. The next investment option we discuss is Bullion Vault – note that when you buy platinum bullion via Bullion Vault, no VAT is payable.

Bullion Vault

Bullion Vault is the biggest online gold investment platform with over $2 billion in stored bullion. In 2017, it expanded its offering to enable its customers to invest in platinum too.

Bullion Vault offers an alternative way to invest in platinum bars. When buying through The Royal Mint, you have the option of taking physical ownership of bullion bars and coins varying in weight from 1oz (28.3g) to 1kg. However, no such option exists with Bullion Vault. This is because the platform enables fractional ownership of platinum ‘good delivery bars‘ which weigh between 1kg and 6kg. These far heavier bullion bars would individually exceed the budgets of the vast majority of private investors and are typically traded by miners, refiners, bullion banks, manufacturers and industrial users. By following this model and acquiring platinum at wholesale weights and prices, Bullion Vault is able to offer lower pricing than The Royal Mint.

Whilst prices are constantly fluctuating, the price differences between the two at the time of writing were as follows:

| Platinum weight | The Royal Mint | Bullion Vault | Saving |

|---|---|---|---|

| 1oz (28.3g) | £722.19 | £626.11 | £84.57 (11.7%) |

| 100g | £2,283.89 | £2,050.00 | £233.89 (10.2%) |

| 500g | £11,223.90 | £10,250.00 | £973.90 (8.7%) |

| 1kg | £22,254.99 | £20,500.00 | £1,754.99 (7.9%) |

When investing in Bullion Vault, the fees to be aware of are commission fees and storage charges. Commission is payable when initially acquiring platinum and is charged at 0.5% on the first $75,000 of purchases with lower fees if investing higher amounts. The same commission is charged when selling platinum. However, the savings generated from buying via Bullion Vault will typically more than compensate for this fee.

In addition, storage fees can be far cheaper than The Royal Mint as only 0.04% per month is charged for platinum storage, though this is subject to the amount you intend to invest as storage is subject to a minimum charge of $8 per month. Platinum is stored in secured vaults and benefits from insurance. Bullion Vault completes daily audits of its holdings, providing daily proof of ownership to investors.

No VAT is payable when investing in platinum bullion via Bullion Vault. This is possible because the purchase of ‘Good Delivery Bars’ is zero-rated for VAT provided your bullion does not leave the London Bullion Market Association approved vault.

Investing in platinum mining companies

An alternative to directly investing in physical platinum is to invest in platinum mining companies whose fortunes are heavily influenced by the price of platinum. By investing in platinum mining companies rather than physical platinum, you can potentially drive profits through both dividend payments and capital appreciation, whereas an investment in physical platinum relies solely on generating a capital gain.

The two largest listed platinum mining companies are:

| Company | Stock exchange | Ticker Symbol |

|---|---|---|

| Anglo American | London Stock Exchange | AAL |

| Impala Platinum | Johannesburg Stock Exchange | IMP |

You can invest in platinum mining companies like the two above using the services of an execution-only platform such as Hargreaves Lansdown (to see a comparison of investment platforms, click here).

Investing in platinum ETCs

Platinum ETCs either aim track the performance of the platinum spot price (price for immediate supply) or future price (price for future supply).

Platinum ETCs can track the performance of these prices through either holding physical platinum in storage or holding derivatives such as swap agreements.

The below platinum ETCs all track the spot price of platinum and are backed by physical platinum held in storage by a trustee:

| ETC name | Ticker symbol | Tracking | Replication method | Ongoing charge (total expense ratio) |

|---|---|---|---|---|

| iShares Physical Platinum ETC | SPLT | Spot price | Physical | 0.4% |

| Invesco Physical Platinum ETC | SPPT | Spot price | Physical | 0.39% |

| Xtrackers Physical Platinum ETC | XPLA | Spot price | Physical | 0.45% |

To invest in one of these platinum ETCs, you can use an execution-only share trading platform such as Hargreaves Lansdown (to see a comparison of investment platforms, click here).

Platinum CFDs – trading platinum

Certainly not one for beginners, but an alternative way for experienced traders to gain exposure to the platinum market is through trading CFDs on platinum futures (symbol: PL) via a trading platform such as Plus 500. CFDs are a leveraged trading product where you can take long or short positions, depending on whether you think the price of platinum futures will rise or fall.