Bitcoin markets have experienced heightened volatility in recent weeks as investor sentiment oscillates between extremes of greed and fear. According to Shubh Varma, CEO of Hyblock Capital, this fluctuation has led to notable shifts in market dynamics, with broader economic conditions playing a critical role in shaping price movements.

Bitcoin’s price, alongside other risk assets, has seen significant movement in response to macroeconomic data and short-term news events. Varma noted that market sentiment has been particularly reactive, shifting quickly from greed to “extreme fear.” These moments of extreme fear have often triggered bullish reversals in the past, as the market tends to overreact to minor changes. “The sentiment shift underscores the fragile nature of current market conditions and the tendency of traders to overreact to fluctuations,” the Hyblock CEO explained.

Hyblock Looks at Macroeconomic Backdrop

The wider economic environment has also impacted the cryptocurrency market, with the U.S. Federal Reserve’s monetary policy playing a key role. The Fed is anticipated to cut interest rates by 50 basis points, with additional reductions expected through the end of the year and into 2026. These cuts are designed to support economic growth, but they also influence risk assets like Bitcoin. Lower rates can make alternative assets more attractive, as they reduce the yield on traditional fixed-income investments.

The recent U.S. Non-Farm Payrolls report sparked significant market volatility. Although unemployment showed a slight decline, the broader trend indicates a gradual rise in joblessness. This triggered what Varma described as an “overreaction” from investors, leading to heightened price swings in Bitcoin. “The overreaction caused heightened volatility, though it may present an opportunity for those paying attention to the broader picture, as markets eventually recalibrate to these realities,” Varma said.

Liquidity and Supply Dynamics

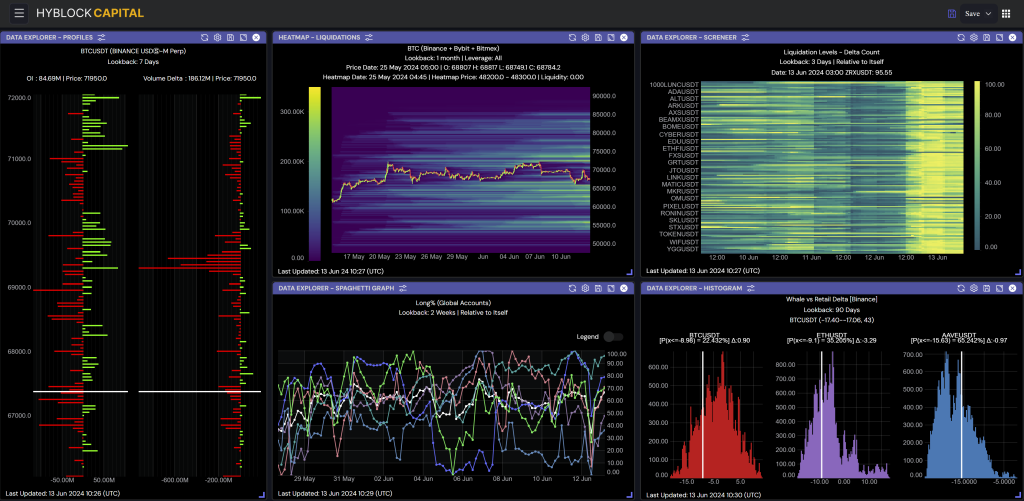

Varma also pointed to key liquidity indicators that suggest potential bullish movements in the near term. One such measure is the combined order book liquidity, which tracks the volume of buy and sell orders in the market. Recently, this liquidity has been relatively low, a sign that price movements could occur more easily due to fewer outstanding orders. According to Varma, this is often seen as a bullish indicator, as reduced liquidity can lead to rapid price increases.

Additionally, the global bid-ask ratio, which measures supply and demand dynamics across more than 1,400 trading pairs, has remained consistently positive. This indicates that despite Bitcoin’s price declines, demand for the asset remains robust. “The sustained positive trend suggests that underlying demand remains strong, positioning the market for a potential rebound,” Varma said.

Hyblock Assesses Political and External Factors Impacting Bitcoin

Political events have also added complexity to the current market environment. Speculation around the 2024 U.S. presidential election, specifically the potential outcomes of a Trump vs. Kamala Harris race, has created additional uncertainty. While market assumptions suggest that a Trump victory could be positive for cryptocurrencies, Varma warned that this expectation might already be priced into the market. Upcoming debates could further shape sentiment.

Bitcoin Prospects

As Bitcoin hovers around key technical levels, Varma noted the significance of liquidity zones around the $58,500 mark. These high-leverage zones, as identified by Hyblock Capital’s heatmaps, could serve as magnets for future price action, potentially leading to increased volatility. “With liquidity concentrated at these levels, this zone represents a critical point of interest as the market evolves in the near term,” Varma concluded.

With a combination of macroeconomic pressures, sentiment shifts, and liquidity factors, Bitcoin appears to be poised for further volatility, but with potential upside opportunities for savvy investors.