Creating a personal financial budget is the first step you absolutely must take in your journey to financial freedom and control.

It is vitally important that you have a strong understanding of both your incomings and outgoings. This allows an analysis of which areas of income and cost can be optimised (increased or decreased) to achieve your goals.

In this article, we aim to set out easy to follow steps for creating your own personal financial budget, but also encourage you to think about how you can set yourself up for success in sticking to the budget you create.

If you are married or in a long term relationship where finances are shared, it is strongly encouraged to undertake this exercise together. Whilst we often find that one partner takes the lead in regard to finances, sticking to a financial budget becomes a lot easier if both partners are on the same page when it comes to joint goals and financial strategies.

Setting a goal: what are you looking to achieve?

Before we put pen to paper on the actual financial budget though, take a moment to write down your goals. What do you actually want to achieve financially?

Are you simply looking to regain control of your money/spending? Are you seeking financial independence/early retirement? Do you want to reduce your working hours but unsure if your finances allow?

We will refer back to this goal after completing the exercise as it can help to frame income goals or amendments required to spending.

Try to make your goal specific and achievable rather than something generic like ‘save £5,000 a month’ when your income is currently £3,000 with expenditure of £2,000. The goal here is to stay motivated, to enjoy the process and the little wins we experience along the way.

Make a full list of income and costs

Once you have your goals jotted down, it’s time to make a full list of all of your monthly incomings and outgoings.

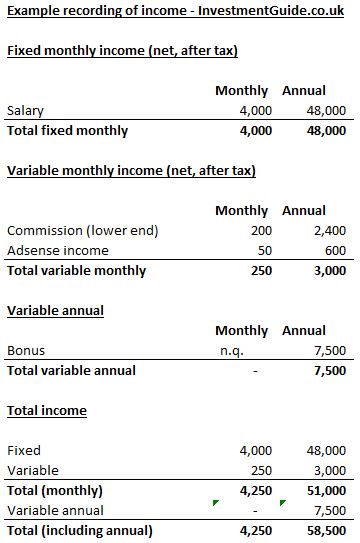

Start with income. This should split fixed monthly income and any variable element. For both, consider net pay rather than gross as this is what actually hits your bank account each month after the taxman raids your coffers.

You should think about the range of income you generate when thinking about any variable pay rather than writing down your best commission month and assuming you will hit that in perpetuity. It might actually be beneficial to use the low-end of this range in your planning.

Make note of expected annual bonus but do not rely on this given it is likely discretionary.

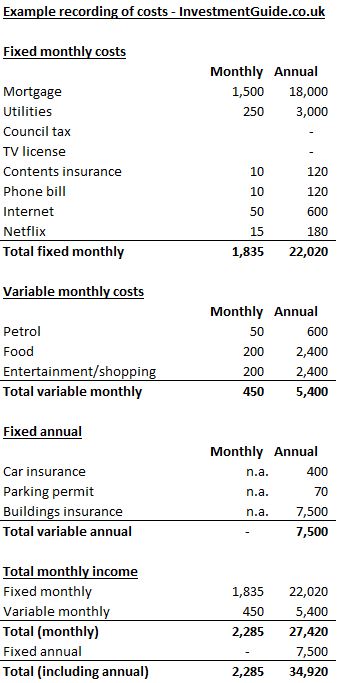

Moving onto costs, again split these into fixed costs you can’t do anything about and discretionary spending where you could, if you wanted to, cut back spending.

Be honest here in your evaluations and revisit bank statements to find out your true level of discretionary spending on areas such as food/takeaway and clothes shopping. We need a full picture of what you are currently spending to understand where savings can be made.

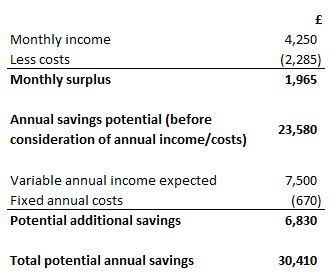

Combine the income and expense analysis to calculate your potential monthly/annual savings rate.

Take stock and consider if you will meet your financial goals based on current income and spending levels

If you are not happy with the level of savings you are currently generating, there are only two ways to increase it: (i) reduce costs, or (ii) increase income.

Decreasing costs

The great thing about doing a financial budget review like this is that you can take immediate action to reduce spending.

We’re all human and most people find that they have areas where they are perhaps unnecessarily spending.

Maybe you signed up to an expensive gym that you aren’t really going to, perhaps a Netflix premium subscription when you could have the standard package, or perhaps your phone is out of contract but you are still paying the higher monthly rate unnecessarily.

Always think about opportunity cost. How much closer will you be to your goal if you make some compromises in spend. Small changes can make a big difference in aggregate.

We aren’t advocating living an existence without any joy, so make sure you are realistic in setting your targets. Keep a budget for social activities but think about how you might be able to cut back (e.g. inviting friends to your home rather than a restaurant, drinking less alcohol when on nights out).

Increasing income

There’s a limit to how much you can cut costs because some expenses are fixed and you still want to enjoy your life.

The other side of the equation to increase your savings rate is to increase your income. Increasing your income is not quite as straightforward as cancelling a few subscriptions and limiting your shopping sprees, but there are things you can think about.

Could you, for instance:

- Ask for a raise

- Work overtime or at enhanced rate for working certain shifts

- Develop your skills such that you can command a higher market rate in your profession

- Take on a side hustle to earn supplemental income on top of your primary job

Automate your finances and pay yourself first

If you don’t set aside money each month for investment or savings, then you aren’t really ‘paying yourself’. You are funding your lifestyle but not putting yourself in a better financial position over time.

Our top tip is to automate your investments. Every month when your salary is paid, transfer £X into an investment platform such as Hargreaves Lansdown, Fidelity or Vanguard. Invest those funds (e.g. into a low cost index tracker) and put your money to work.

If you set this up as a recurring contribution, you won’t have to think about it every month and it guarantees that you are setting money aside to meet your goals.

Bank account organisation for couples

A common strategy which works well is to have a joint bank account which both partners salaries are paid into and from which all bills are paid.

Each partner then has their own personal bank account and an agreed upon allowance which is paid from the joint account each month once automatically once salaries are paid in. The money held in those personal accounts is each partners to do with as they like. Spending from this account should not be judged or questioned.

The joint account, however, should have set rules on spending which should be adhered to, with any excess funds being designated for saving/investing. Again, the automation tip mentioned above can be used to ensure that money is set aside each month.

Revisit and review your budget every month or every few months to see how you are tracking against your goal

Update for any changes in income and/or expenditure so that you have an up-to-date picture of your savings rate potential and can check if any discretionary spend has risen once again.

Many people also find it useful to maintain a log of expenditure each month so that you (i) know your financial position at any given point in time, and (ii) can track spend by category (e.g. food, entertainment, clothes, etc).

You should also review your investment accounts to check performance. However, don’t get carried away in checking too routinely. Investments can go down as well as up, but provided you continue to invest over time and put your money in diversified funds or a low cost index trackers, the odds are on your side to profit in the long term. By checking regularly, you may be disheartened if the market moves against you or you may be tempted to change strategy unnecessarily.

Finally, don’t be afraid to refresh or revisit goals if needed

Priorities may change, for example, if you or your partner is pregnant, if you experience issues with your home or car, or if you need to move elsewhere due to work.

Don’t be hard on yourself if you don’t stick to the budget 100%. Try your best and keep your goals in mind at all times. If you remember what you are aiming for and it feels as though it’s within reach, it becomes a lot easier to make decisions which will help you to meet that goal.