The trade creditor days measure essentially allows you to calculate how long it is taking a business to pay its suppliers.

Comparing the average trade creditor days in the current period to the prior period average allows you to consider whether the business is paying its debts faster/slower. Of course, a change in days could also be driven by a range of other factors – see ‘what can impact trade creditor days’ section below.

There are a number of ways to calculate trade creditor days, with many accountancy books often advocating the most simplistic, but not necessarily the best methodology. We will later discuss the various calculation methods, but first, let’s revisit the basics.

What are trade creditors?

A trade creditor is a supplier who has sent an invoice to the business for products/services, but whom you have not yet paid for those goods/services.

The opposite debit accounting entry when recognising a trade creditor on the balance sheet will be:

- Expense line in P&L (where the invoice relates to the relevant period but an accrual has not yet been made)

- Accruals (where an accrual has already been recognised on the balance sheet i.e. an expense has already been recorded to create that accrual)

- Prepayments (where you have received an invoice and want to recognise it in the system, but where the expense does not relate to the current period)

Balances leave the trade creditor balance when they are paid or written off:

- Paid (Dr Trade Creditors, Cr Cash)

- Written off (Dr Trade Creditors, Cr P&L)

If we receive an invoice for £120 which is inclusive of £20 VAT at the standard rate, the trade creditor balance would be £120. This is because the gross figure, including VAT, would be recognised in trade creditors. The full accounting entry would be Dr Expense (P&L) 100, Dr VAT (BS) £20, and Cr Trade creditors (BS) £120.

This consideration of VAT is important, though is commonly forgotten. You need to remember to consider VAT when calculating trade creditor days.

How to calculate trade creditor days

There are numerous methods of calculating trade creditor days.

The basic method of calculating trade debtor days

Most books and websites cite the basic method which takes the trade creditors balance multiplied by 365 divided by cost of sales.

There are a few problems with this methodology, notably:

- Cost of sales alone do not drive trade creditors. All invoices that you receive from external suppliers will impact trade creditors. This means that you also need to take into account overheads.

- In addition, not all costs within cost of sales and overheads impact trade creditors at month-end. For example, expenses relating to staff costs would be included in the P&L, but would typically be paid prior to month-end and would not impact trade creditors.

- Costs are unlikely to be constant throughout the year – there will be monthly fluctuations in costs. Costs incurred at the start of the year are unlikely to still be impacting trade creditors at year end for example, as the invoices relating to those expenses are likely to have already been settled.

- This also ignores the fact that you need to consider VAT and gross-up the relevant expense lines. This is because costs in the P&L are shown net of VAT, but trade creditors on the balance sheet are gross of VAT.

So if the standard method isn’t great, what is better?

The count back method of calculating trade creditor days

Using the count back method for calculating trade creditor days, combined with an appropriate cost driver (incorporating all costs which impact trade creditors, and adjusted for VAT) is a far better option.

The count back method for calculating trade creditor days first considers expenses incurred in the most recent month rather than factoring in expenses incurred across the whole year. It then looks back to the prior month, and then the month before, until the full creditors balance has been accounted for. It sounds complicated but it’s pretty simple if you work through it step by step.

For example:

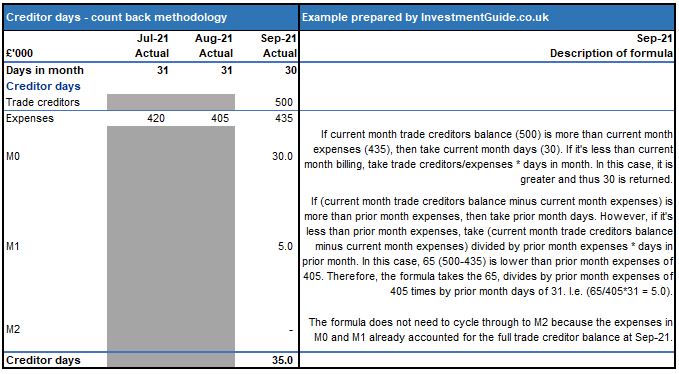

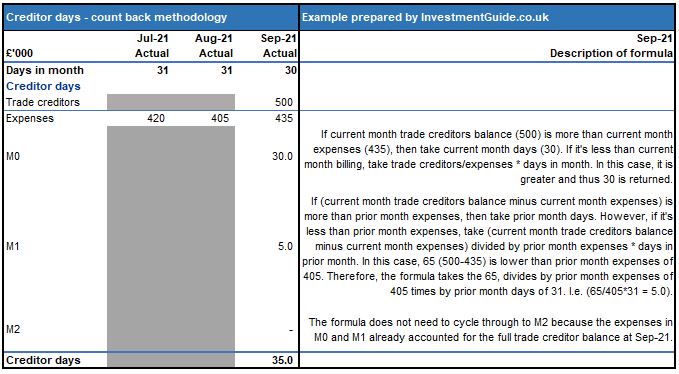

The above example shows you how you would calculate trade creditor days at September 2021 using the trade creditor balance and relevant expenses for the prior three months. This is an example for one month only, but you would typically drag across the formula to create a monthly runner.

- M0 (looks at current month) – If current month trade creditors balance (500) is more than current month expenses (435), then take current month days (30). If it’s less than current month billing, take trade creditors/expenses * days in month. In this case, it is greater and thus 30 is returned.

- M1 (looks at prior month) – If (current month trade creditors balance minus current month expenses) is more than prior month expenses, then take prior month days. However, if it’s less than prior month expenses, take (current month trade creditors balance minus current month expenses) divided by prior month expenses * days in prior month. In this case, 65 (500-435) is lower than prior month expenses of 405. Therefore, the formula takes the 65, divides by prior month expenses of 405 times by prior month days of 31. I.e. (65/405*31 = 5.0).

- M2 (looks at 2 months ago) – The formula does not need to cycle through to M2 because the expenses in M0 and M1 already accounted for the full trade creditor balance at Sep-21.

What can impact trade creditor days?

If trade creditor days have increased, payments to suppliers are being made slower. Conversely, if trade creditor days decrease, suppliers are being paid faster.

Factors which could impact the trade creditor days trend include:

- Longer or shorter terms being agreed with suppliers

- Supplier disputes leading to the business holding back funds

- Changing supplier mix (as different suppliers may have different terms)

- Early payment discounts may encourage a business to pay suppliers faster

- Availability of cash in the business. A business flush with cash is far more likely to pay its suppliers to agreed terms.

- Industry practice – certain industries will withhold payment (e.g. building industry is well known for delayed/late payments and retentions)

Whilst improving working capital is important, businesses must factor in the importance of maintaining positive supplier relationships. If you treat suppliers as a temporary source of funding by extending agreed upon payment terms, they are unlikely to prioritise your business needs in future over their other customers who pay to agreed upon terms.