Ground rent investment involves acquiring the freehold title of residential or commercial leasehold property. As ground rent investments are illiquid in nature, they are best suited to investors who do not require immediate access to their funds.

Ground rent investments provide an opportunity for cautious investors to gain exposure to the UK property market with fewer risks than traditional buy-to-let property investments. However, finding appropriate ground rent investment opportunities can be more difficult than finding buy-to-let opportunities as (i) supply is limited, and (ii) close relationships with house-builders are often required to source the best deals.

This article will focus on residential ground rent investments.

What is ground rent

The owners of leasehold property in England and Wales will typically have to pay ground rent to the freeholder of the property. The terms of the lease dictate when and how much ground rent is payable.

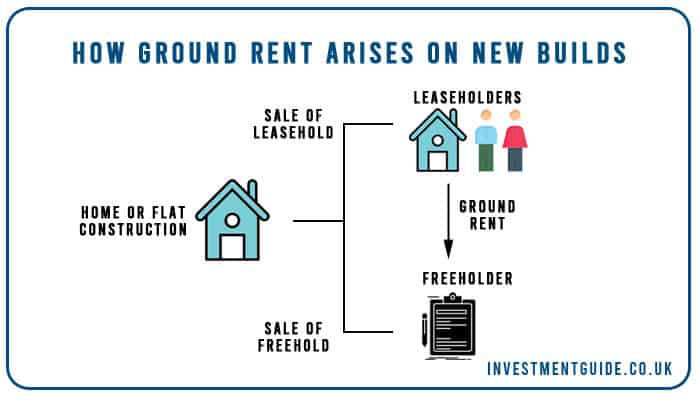

The freeholder has ownership of the land and property attached to that land, whereas a leaseholder holds the right to reside in a property for a specified length of time.

Someone investing in freehold titles with long-leaseholds granted over the property is said to be investing in ‘ground rents’.

Ground rent charges are typically small in comparison to the value of the leasehold property. There are no limits on the level of ground rent that can be charged provided both parties agree on the terms. Ground rent charges can range from just £10 to upwards of £1,000 in some cases.

As ground rent remains payable for the duration of the leasehold term in line with the terms agreed, the freeholder can estimate his/her future cash flows with a strong degree of accuracy (subject to no enfranchisement or leasehold extension).

If the leaseholder defaults on his/her ground rent obligation, the freeholder has the right to repossess the property. As the underlying property is generally worth far more than the agreed ground rent charges, the leaseholder is highly incentivised to continue paying the ground rent that they are contractually obliged to pay.

The freeholder does have some obligations (noted in the drawbacks section below) and must also manage the administration of invoicing leaseholders and checking that payment has been made.

How is ground rent determined

The amount charged for ground rent varies between properties as it is dictated solely by the terms of the leasehold contract. Any amount of ground rent can be agreed between the freeholder and leaseholder, provided both parties are happy with the terms they are entering into.

Ground rents will typically commence at a fixed value but will rise over time according to an agreed price increase mechanism based on either:

- Inflation linked measures such as the Retail Price Index (RPI) or Consumer Price Index (CPI)

- Fixed increases at certain intervals. For example, doubling after X number of years.

- Open market review, meaning ground rents rise as the capital value of the property increases over time.

Reversionary ground rent investments

When a property is sold on a long leasehold basis, the leaseholder only holds the right to reside in a property for a specified length of time.

Residential flats are often sold on a long leasehold basis, with terms of between 95 and 999 years typical. The freeholder of the property maintains the right to take ownership of the underlying property at the end of the lease term. This is referred to as the ‘reversionary’ interest.

When the leasehold term reduces to below 80 years, the value of the freehold title / ground rent investment rises. This is a function of the right included within the Leasehold Reform Act of 1993, which dictates that should a new lease be required by the leaseholder, the leaseholder must pay 50.0% of the ‘marriage value’ to the freeholder.

The ‘marriage value’ is defined as the uplift in property value following completion of the lease extension.

Ground rent investment – the benefits

- Very low default rates – As the relative value of ground rent charges is typically far lower than the value of the leasehold property, default rates are typically very low because the freeholder has the right to repossess in the event of non-payment.

- Strong security – As noted above, the freeholder has the highest level of security over the underlying property and can repossess if the ground rent is not paid.

- Predictable long-term cash flows – The future cash flows attributable to ground rent investments are both long term and predictable.

- Supplemental income streams – There is potential to earn additional income as a freeholder from other areas such as recharging insurance cover, service charges and profit from leaseholders extending leasehold terms (particularly where the lease has run down to have less than 80 years remaining).

- Price increase mechanisms – Leasehold contracts typically include price increase mechanisms for ground rent payments which can ensure that repayments keep pace with inflation.

Ground rent investment – the drawbacks

- Responsibilities as freeholder – The freeholder is usually responsible for repairs and maintenance of the exterior/common parts of the leasehold building. In practice, the freeholder arranges and renew buildings insurance which the leaseholder pays for. When looking at a potential ground rent investment, it is important to check the leasehold terms to determine what each party is responsible for. For example, lease terms may dictate that the freeholder would be liable for paying an excess in the event of a claim against the insurance policy.

- Administration burden – Whilst leaseholders are typically only invoiced annually for ground rent charges, this can be an administrative burden.

- Enfranchisement can reduce predictability of cash flows – The ability of residential leaseholders to enfranchise (which means purchase the freehold title from the freeholder) reduces the ability of freeholders to predict future cash flows. The likelihood of enfranchisement is greatly reduced when acquiring the freehold on a block of flats as all flat owners must agree to the enfranchisement. Full legal guidance on enfranchisement is available here.

- Leasehold extensions can reduce the predictability of cash flows – Whereas enfranchisement refers to the process of the leaseholder acquiring the freehold title, the leaseholder also has a legal right to extend their leasehold period by 50 or 90 years for a house or flat respectively. If the leaseholder enforces this legal right without negotiation, a premium will be payable to the freeholder after which no ground rent will remain payable for the remainder of the lease term. Alternatively, an extension can be mutually agreed with the freeholder. Again, this reduces the predictability of future cash flows. Full legal guidance on the legal right to lease extension is available here.

- Gearing can be difficult – Unless you are making a large ground rent investment, it can be difficult to access bank funding for your purchase. For this reason, many private ground rent investors choose to pay in cash.

How to invest in ground rent

The ground rent market is made up of existing ground rent holdings and new ground rents created as a result of new property development.

As such, the main ground rent sellers are builders of new residential apartment blocks. For example, Savills estimated that in 2016, ground rents with capital value of £250 million were generated in the UK market from new build homes alone.

There are multiple options for sourcing ground rent investments, including:

- Property auctions – Ground rent investments are frequently listed at property auctions. Be weary of buyers premium costs when bidding at auction and do your research beforehand to ensure you know the maximum value you are willing to pay.

- Establishing direct relationships with property developers – By establishing direct relationships with property developers, you may be able to cherry pick strong ground rent investment opportunities before they come onto the open market.

- Using a specialist ground rent broker – A specialist broker is likely to already have established relationships with property developers and will be able to connect you with the right people in exchange for a fee for acting as a middleman.

- Transacting privately with existing holders of ground rents – This requires knowing the right people who are looking to dispose of their investments.

Selling ground rent investments

If you decide that it is time to sell your ground rent investments, you should be aware that leaseholders must be given the right of first refusal. This right must be served by formal notice (a Section 5 notice) and time must be given for the offer to be considered.

During this time, you cannot sell the freehold title to another party. Further, the title cannot be offered to any other investor on different terms to those offered to the current leaseholders.

In certain scenarios, serving a Section 5 notice may not be required. For instance, where you are selling an entire company which holds ground rent investments or where you are selling the freehold title for a newly build block of apartments. Full legal advice on this matter can be found here.