The FTSE 100, FTSE 250, FTSE 350 and FTSE Small Cap stock market indices are wholly owned by the London Stock Exchange (‘LSE’). The acronym ‘FTSE’ actually stands for ‘Financial Times Stock Exchange’ as the indices were a joint venture between the Financial Times news publication and the London Stock Exchange when they launched in 1984.

The LSE operates two markets in the UK, the main market and the AIM market. Companies listed on the main market can have a ‘premium’ or ‘standard’ listing, with different rules applicable to each.

The FTSE indices only list companies which have a ‘premium’ listing. Premium listings are typically reserved for larger companies as in order to maintain this listing, companies incur higher costs and must meet the highest standards of regulation/corporate governance.

FTSE 100

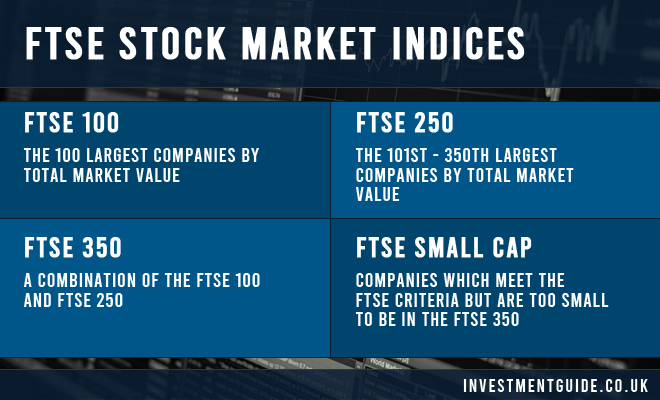

The FTSE 100 is commonly referred to as the ‘Footsie’. It is a stock market index comprised of the 100 largest UK listed companies with premium listings. The value of the FTSE 100 is determined by the total market capitalisation (value) of its constituents. As the total market capitalisation of each of the constituents changes, the value of the FTSE also changes in real time.

The FTSE 100 is weighted based on market capitalisation. This means that movements in the value of the biggest companies (by total value) will have a greater impact on the value of the FTSE than the smallest companies.

At the time of writing, the FTSE 100 total market capitalisation is £1,516,013m. The largest constituent is worth £109,418m (7.2%) whilst the smallest constituent is worth £1,867m (0.1%).

Every quarter (in March, June, September and December), the FTSE 100 is updated. However, if the 105th biggest company by value became the 99th biggest company by value, this would not be enough to join the FTSE 100.

A company would only be added to the FTSE 100 stock market index if its rank rises to 90th or higher. A company would only be removed from the FTSE 100 index if its rank fell to 111th or below.

This methodology ensures that the FTSE 100 continues to track the largest UK listed businesses but does not suffer from continuous changes to its constituents near the threshold for exclusion.

Movements in the value of the FTSE 100 are a good indicator of overall market sentiment. However, as many of the companies included in the FTSE 100 are multinational, index performance is a fairly weak indicator of the performance of the UK economy.

The FTSE 250 is commonly seen as a better indicator of how the UK economy is faring as it contains a smaller number of internationally focused companies.

FTSE 250

The FTSE 250 is also a capitalisation-weighted stock market index. It differs from the FTSE 100 in that it comprises the 101st-350th largest UK listed companies with premium listings.

The FTSE 250 is similarly updated on a quarterly basis. A company would only be added to the FTSE 250 stock market index if its rank rises to 325th or higher. A company would only be removed from the FTSE 250 index if its rank fell to 376th or below.

FTSE 350

The FTSE 350 combines the FTSE 100 and the FTSE 250 in that it tracks the 1st to 350th largest UK listed companies with premium listings.

FTSE Small Cap

The FTSE Small Cap incorporates all companies which meet the FTSE criteria but which are too small to be part of the FTSE 350.

FTSE All-Share

The FTSE All-Share is the aggregation of the FTSE 100, FTSE 250 and FTSE Small Cap indices.

Can I buy the FTSE indices?

No, it is not possible to buy the FTSE 100, FTSE 250, FTSE 350, FTSE Small Cap or FTSE All-Share as they are stock market indices rather than investment vehicles.

However, it is possible to invest in passive index tracker funds which aim to match the performance of the indices. Learn more in our article about index trackers.

It is also possible to buy CFDs through trading platforms such as Trading 212 or IG to speculate on the price movements of the FTSE indices without owning the underlying asset.