Plenty of smart people get confused by the deferred tax concept, which is understandable because if you’ve not come across it before, it can be a bit confusing to get your head around. In this article we seek to demystify deferred tax assets and liabilities by breaking down what drives deferred tax with numerical examples.

What is deferred tax?

Deferred tax is an accounting construct and can be both a liability or an asset on the balance sheet. It arises where differences arise between accounting and taxable profits.

More specifically:

- Deferred tax liabilities represents corporation tax payable in future periods in respect of taxable temporary differences.

- Deferred tax assets represent corporation tax recoverable in future accounting periods in respect of deductible temporary differences or the carry forward of unused tax losses or tax credits.

Accounting profit vs taxable profit

The first important concept to understand is that accounting profit (I.e. Earnings Before Tax per the profit and loss, based on accounting standards) is different to taxable profit which is profit as determined by the rules of the relevant tax authority.

Where the two are identical, no deferred tax asset or liability arises. However, where there are temporary differences between them, deferred tax arises.

Before we jump into what temporary taxable differences are, you should understand that the ‘corporation tax expense’ shown on the face of the profit and loss statement includes both current tax (i.e. the amount of corporation tax payable or receivable in respect of the current period – determined by taxable profit multiplied by the relevant corporation tax rate) and deferred tax movements.

What are taxable temporary differences?

The official definition of a temporary difference is ‘a difference between the carrying amount of an asset/liability on the balance sheet and its tax base’.

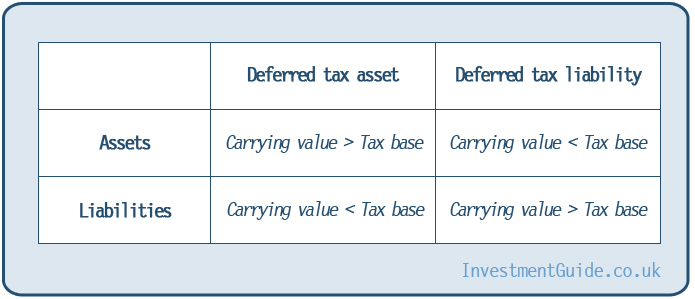

A taxable temporary difference arises where the carrying value of a company’s asset is greater than its tax base, or where the carrying value of a liability is less than its tax base. This results in a deferred tax liability.

Conversely, where the carrying value of a company’s asset is lower than its tax base or carrying value of a liability is greater than its tax base, a deductible temporary difference arises resulting in a deferred tax asset.

Great, but what does that actually mean? Let’s look at one of the most popular examples – the purchase of tangible fixed assets.

Deferred tax liability example

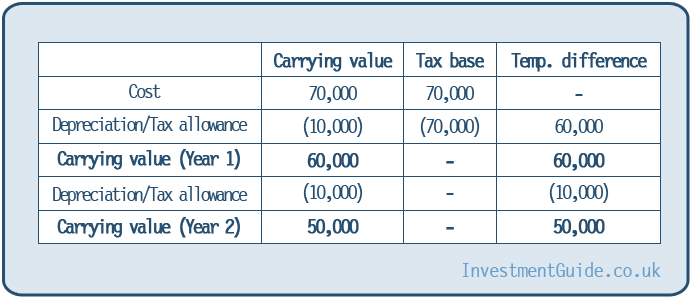

Let’s imagine a business acquires a new piece of machinery for £70k. Its accounting policy is to depreciate this asset on a straight line basis over 7 years, resulting in £10k depreciation recorded in the profit and loss per annum.

Depreciation, however, is not an allowable expense for tax purposes. Instead, HMRC has a capital allowance system which determines how businesses can write off the cost of the asset against profits.

If HMRC were to allow the business to deduct the full £70k against current year profits (e.g. under the annual investment allowance), there would be a large disconnect between accounting and taxable profits in the year, as shown in the table below.

In year 1, accounting profit before tax would be £100k, but taxable profit would be just £40k (i.e. £100k plus £10k dis-allowable depreciation expense, less £70k allowable capital expenditure under AIA). The current year tax expense would be £7.6k (£40k taxable profit * 19% corporation tax rate) and the temporary taxable difference would be £60k, resulting in a deferred tax liability of £11.4k (£60k * 19% corporation tax). The total tax expense recorded in the profit and loss would be £19k (current tax of £7.6k plus deferred tax movement of £11.4k). In this simplified example, this is equal to the accounting profit * 19% corporation tax rate (£100k * 19% = £19k).

Relevant tax journal entries:

- Dr Tax Expense (Current Year Tax) £7.6k

- Cr Corporation Tax Creditor £7.6k

- Dr Tax Expense (Deferred Tax) £11.4k

- Cr Deferred Tax Liability £11.4k

In Year 2, the deferred tax liability would begin to unwind. Why? Let’s imagine the same company has £100k accounting profit in Year 2 after deduction of its second year of depreciation, but makes no further capital additions. Its taxable profit in Year 2 would be £110k (£100k accounting profit plus £10k dis-allowable depreciation). The temporary taxable difference (i.e. the difference in carrying value of the asset and the tax base value) has fallen to £50k resulting in a deferred tax liability of £9.5k (£50k * 19% corporation tax rate). The reduction in the deferred tax liability is £1.9k (£11.4k – £9.5k) whilst the current year tax expense is £20.9k. The total tax expense recorded in the profit and loss would be £19k (current tax of £20.9k less the deferred tax movement of £(1.9)k). Again this is equal to the accounting profit * 19% corporation tax rate (£100k * 19% = £19k).

Relevant tax journal entries:

- Dr Tax Expense (Current Year Tax) £20.9k

- Cr Corporation Tax Creditor £20.9k

- Cr Tax Expense (Deferred Tax) £1.9k

- Dr Deferred Tax Liability £1.9k

Deferred tax asset example

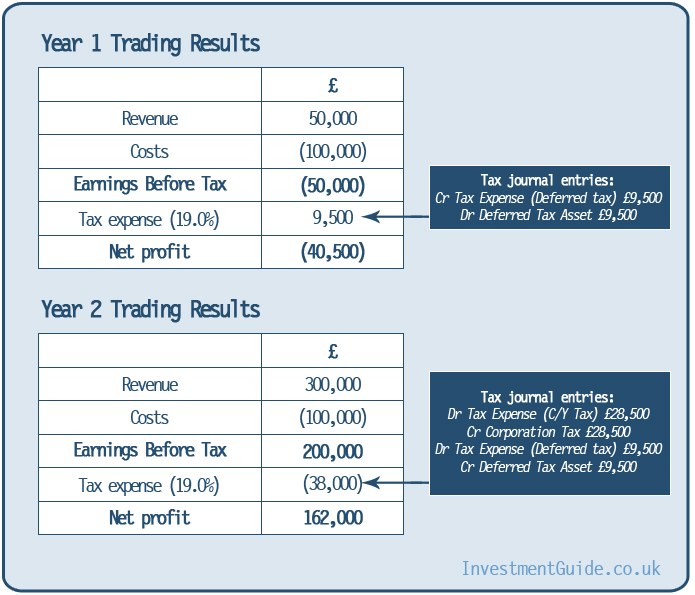

A deferred tax asset can arise in relation to unutilised tax losses carried forward. For example, a start-up company which has an accounting loss before tax of £50,000 in Year 1 of trading would recognise a deferred tax asset of £9,500 (£50,000 * 19%).

In Year 2, if an accounting profit before tax of £200,000 is generated, the tax losses of £50,000 can be offset, resulting in taxable profit of £150,000. The current year tax expense would therefore be £28,500 (19% * £150,000). However, the deferred tax asset also has to be released as the carry forward tax losses have been utilised.

What are permanent taxable differences?

Permanent taxable differences on the other hand are differences between accounting and taxable profits which are not expected to reverse in future periods. One example of a permanent difference would be a fine. Fines are rarely tax deductible and thus no deferred tax would be recognised.

For example, a company has profit before tax of £100k which includes a fine of £10k. Its taxable profit would be £110k (£100k plus add back of the non deductible £10k fine). Current tax would then be 19% (current corporation tax rate) multiplied by £110k = £20.9k. The accounting entry would be Dr Tax Expense (Current Tax) £20.9k, Cr Corporation Tax Liability £20.9k. No deferred tax is recognised in relation to this difference between accounting and taxable profit, as the difference is regarded as permanent (i.e. the tax authority is not going to change its mind regarding the expense being non-deductible.

Are deferred tax assets/liabilities current or non-current?

All deferred tax assets and deferred tax liabilities are regarded as non-current on the balance sheet.