To buy, send or receive cryptocurrency, you must setup a ‘wallet’. Once setup, only you can access your wallet.

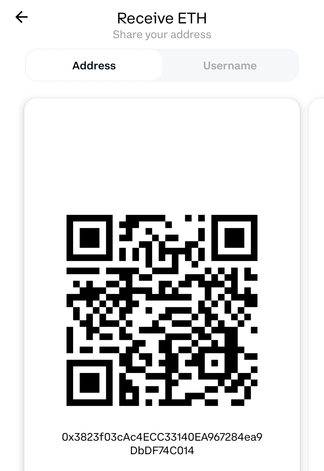

If you want to someone to send you cryptocurrency, you must send them an ‘address’ (also known as a ‘public key’). The below code is an example of a public key to receive Ethereum, which has an associated QR code.

Whoever is sending you cryptocurrency will require your public key. However, each public key has a corresponding ‘private key’ which only you have access to. This is confidential and should not be shared with other parties. Similar to the public key example above, your private key will be a large string of letters and numbers.

Your cryptocurrency wallet is effectively your own store of your private keys. Cryptocurrency is not actually stored in the wallet. Rather, it is stored on the blockchain.

Types of cryptocurrency wallet

This means that your cryptocurrency wallet could be as basic as a paper wallet. A paper wallet is where you physically write down your private keys on a piece of paper which you store somewhere safe/secure.

Remember, if you lose your private key, you lose access to your cryptocurrency. For that reason alone, paper wallets are often not the best solution. Further, one of the selling points of cryptocurrency is that it is digital money. Using your cryptocurrency if it is stored in a paper wallet is not particularly convenient.

For these reasons, most people opt to use online wallets or hardware wallets.

Online wallets (also known as ‘hot’ wallets)

Two of the most popular cryptocurrency exchanges in the UK are Crypto.com and Coinbase.com. When you sign up to these major exchanges, you immediately receive a wallet which you can use to trade, sell and store your cryptocurrency.

These exchanges are custodial, meaning you do not have full control over your private keys. Instead, your private keys are stored/managed by the platforms on your behalf. When storing cryptocurrency on the exchanges, you will always, at least to some extent, be at the whim of a third party e.g. you may be subject to changes in fees or withdrawal limits.

Both of these platforms also operate non-custodial wallets (Crypto.com wallet and Coinbase Wallet apps respectively). These non-custodial wallets differ in that they allow users to fully control their own private keys.

Both custodial and non-custodial online wallets feature reduced security compared with offline wallets (e.g. hardware wallets) which are not connected to the internet. This is because online wallets are more susceptible to security risks like hacking and viruses.

Security and confidence in online wallets has been improving over time. For example, if using a major exchange such as Crypto.com or Coinbase.com, significant funds are allocated by the platforms to security. Further, the majority of custodial cryptocurrency is held in offline storage and insurance coverage is held against loss. Despite this, most industry experts still agree that offline hardware wallets provide a far greater level of security.

There are also, of course, a number of advantages to online wallets. The big ones are convenience, ease of access and use, and cost. Operating an online wallet is not dissimilar to having an online bank account. Wallets are free to create and it is quick to exchange your cryptocurrency back into fiat currency (Pound Sterling).

Hardware wallets (also known as ‘cold’ wallets)

The most popular cryptocurrency hardware wallets in the UK are Ledger and Trezor – these are hardware devices which have no connection to the internet. They are physical products which store your private keys offline. When you want to access your cryptocurrency, you need to connect your hardware wallet to a computer.

The major advantage of a hardware wallet over an online wallet is that the device cannot be digitally hacked if it is kept offline. This means that hardware wallets provide a higher degree of security.

For this reason, those with significant cryptocurrency holdings typically opt to use hardware wallets.

Crypto newcomers on the other hand, often start with an online wallet because they are more accessible and do not require any upfront investment. It is not uncommon to then convert to a hardware wallet as (i) the value of crypto holdings grow, or (ii) individuals learn more about the security benefits of hardware wallets.

When transacting with a hardware wallet, you use software provided by the manufacturer (e.g. Ledger Live for Ledger) to initiate transactions. The hardware wallet is then connected to a computer and must be used to authorise the transaction – during this process, the hardware wallet remains offline.

People sometimes wonder what would happen if you lose a hardware wallet. If the device is lost or the physical device fails, your private keys are not lost provided you still remember/have access to your seed phrase (which is setup when first purchasing and setting up your hardware device).

Accessing your cryptocurrency wallet

If using a custodial online wallet, you will setup a password to access your account. If you lose your password, you may be able to reset it. However, if you lose your password to your non-custodial online wallet, you are likely to lose access to all of your cryptocurrency assets.

For non-custodial online wallets and hardware wallets, you will setup both a password/pin and ‘seed phrase’ (a list of 12/18 or 24 randomly generated words).

The seed phrase acts as a recovery option should you forget your password or lose access to your device. Both your password/pin and seed phrase must be kept private, as if another user gained access to either, they would have control over all cryptocurrency held in your account.

What is the best cryptocurrency wallet in the UK?

Hopefully after reading this article, you will now understand that how you want to secure your cryptocurrency comes down to personal preference.

Some place greater value on the usability and access of online wallets (Crypto.com, Coinbase.com), whilst others value the next-level security offered by hardware wallets (Ledger, Trezor).

Whichever option you choose, remember to be sensible in following best practice security guidelines as the leading cause of cryptocurrency scams is social engineering (i.e. third parties convincing individuals to provide with their private keys).