Customer acquisition cost, or CAC as its commonly known, is an important metric frequently used by many businesses, particularly in SaaS and other web based businesses.

CAC is effectively a calculation of how much it costs to acquire a new customer. It is often compared to customer lifetime value (LTV) because a strong understanding of how much it costs to acquire a customer vs. how much profit that customer will generate on average is powerful.

Not only is this powerful for the Management team, but also to potential external investors. Management can use the CAC and lifetime value metrics to help plan marketing/sales strategy and optimize return on capital, whereas potential investors can use them alongside market sizing research to gauge the potential for scalability.

How to calculate CAC

The simple methodology is the cost of acquiring a customer divided by the number of customers acquired in that period. The cost of acquiring customers should be the direct sales and marketing costs of acquiring a customer.

This distinction between ‘direct’ and ‘indirect’ is important. For example, marketing and sales staff may spend a proportion of their time servicing the existing customer base. The costs relating to servicing the existing customer base should not be included in the CAC calculation as they do not directly relate to new customer acquisition.

Of course, its important to remember that CAC may be higher during the start-up phase if the company has longer term marketing goals (i.e. marketing spend focused on brand recognition rather than performance marketing focused purely on conversion). This should be taken into consideration when assessing the metric and its potential to reduce as the company scales and/or changes its marketing strategy.

A company may therefore wish to attempt to calculate CAC by marketing channel. Knowing which channel features the lowest CAC would allow the marketing team to increase their focus on this area. However, this adds a layer of complexity as it can often be difficult to track which marketing source led to a customers purchasing decision.

For online businesses, it is possible to track customers back to their last touch attribution source via tools such as Google Analytics. This can work brilliantly if you are advertising via paid search, but would not work as well if one of the main sources of traffic was the sponsorship of a sports club.

Balancing sales and marketing spend

Achieving the right balance between the sales and marketing functions is important. A sales team with little marketing support will not be successful as the sales team will be forced to focus on outbound sales efforts which are often less fruitful. Conversely, if expenditure on marketing results in too many leads for the sales team to handle, an optimum return will not be achieved. The key is right-sizing the sales and marketing teams/efforts and growing them simultaneously to ensure optimum effiency/productivity.

How is customer lifetime value (LTV) calculated and why does it matter?

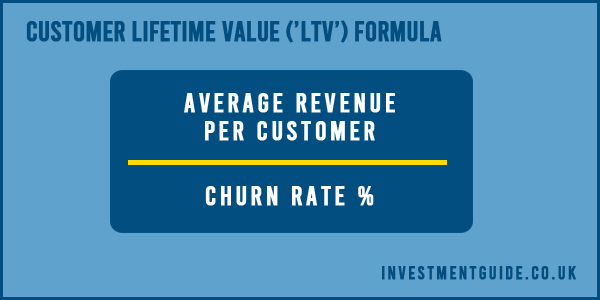

Customer lifetime value is calculated by taking the average profit generated per customer each period divided by churn rate.

For example, if a subscription business has annualised revenue of £1m at the end of FY02 from 1,000 customers, the average revenue per customer is £1,000 (1,000,000/1,000). The business has a 85% gross profit margin which means the average gross profit per customer is £850. Between the end of FY01 and FY02, the business lost £50,000 of annualised revenue, representing a churn rate of 4.8% (50,000/1,050,000). The customer lifetime value would therefore be £850 / 4.8% = £17,708.

In the above example, if the churn rate were to decrease to 2.4%, the LTV would double to £35,416. Conversely, if churn increases by 2.4ppts to 7.2%, the customer lifetime value would decrease to just £11,805. This highlights the importance of customer satisfaction through improving both product and customer service quality.

Customer satisfaction also increases the likelihood of referrals. Inbound leads via referrals often achieve the highest conversion rates as customers already have a level of trust, passed from the existing customer.

You could also incorporate a discount for time value of money into the calculation, to take into account that money earned in the future is worth less than the same amount of money today. However, not all companies do this as they assume that price rises will be implemented to offset the impact of inflation.

What is a good lifetime value to CAC ratio?

For a SaaS business, a good LTV to CAC ratio will generally exceed 3:1. Ideally, a business should be able to recover the CAC within a 12 month period.

If you have a ratio closer to 1:1, then it is a good indication that the business is spending too much on acquiring its customers.

If a business has an extremely high LTV to CAC ratio, this is not necessarily a positive as it could indicate an underspend on marketing (i.e. the business could be growing faster with increased marketing investment).

Whilst the LTV to CAC ratio can be a good barometer of future growth potential, it can be votalile where a business has a high customer concentration. For example, churn could be low in one year but high in the next if one of the larger customers churns. This would drive a significant change in customer lifetime value which would, reducing the ratio significantly.