This article will explain the differences between income yield, redemption yield (also known as ‘yield to maturity’), yield to call and yield to worst. It will also teach you how to calculate bond yields in Excel.

In order to illustrate, lets imagine we are considering acquiring a 20-year bond with a 7% coupon rate (semi-annual payments), par value of £1,000 and current market price of £1,050. The bond was originally issued on 31/03/2010. Today’s date is 31/03/2020 and the bond is due to expire on 31/03/2020.

Income yield

The income yield calculates the expected income-only rate of return on a bond. It does not factor in the potential for capital gain or loss at maturity date (i.e. it does not consider the fact that in this example, we are paying £5 over the par/redemption value of the bond).

Income yield calculation

The income yield is calculated by simply taking the annual coupon payment of £70 (7% coupon rate * £1,000 par value) and dividing by the current market price of £1,050.

Income yield:

- = Annual coupon payment / current market price

- = 70 / 1,050

- = 6.67%

Redemption yield

The redemption yield calculates the expected rate of return if we purchase a bond today and hold it until maturity. This is a more nuanced calculation than ‘income yield’ as it considers the potential capital loss/gain on maturity of the bond.

Redemption yield calculation

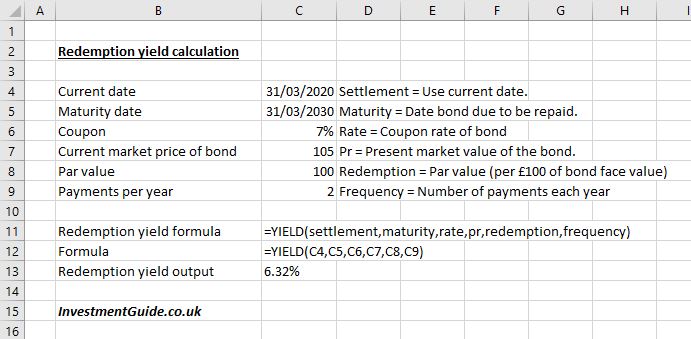

Whilst it is possible to calculate redemption yield manually, it requires iterative calculation. It is therefore far easier to calculate redemption yield in Excel using the ‘YIELD’ function.

The ‘yield’ function requires the following inputs to calculate redemption yield:

=YIELD(settlement,maturity,rate,pr,redemption,frequency)- Settlement = The current date. In this example, we will use 31/03/2020.

- Maturity = The date the bond is due to be repaid by the bond issuer. In this example, the bond maturity date is 31/03/2030.

- Rate = The coupon rate of 7%.

- Pr = The present market value of the bond. Whilst the present value of the bond is £1,050, Excel requires the ‘pr’ input to be given as the value per £100 of bond face value. We therefore need to divide by 10 to arrive at £105.

- Redemption = The future repayment value of the bond at the maturity date. Again, Excel requires the redemption value to be stated as the value per £100 of bond face value. We therefore need to divide £1,000 by 10 to arrive at £100.

- Frequency = The number of payments expected per year. As this bond pays semi-annually, the frequency is 2. Alternatively, we could also use annual (1), quarterly (4), monthly (12) or any other frequency rate as desired.

The redemption yield for this bond is 6.32%. This is lower than both the coupon rate and the income yield as the bond is currently trading at a premium to par value.

Yield to call

Most corporate bonds are repaid by the bond issuer on the maturity date. However, certain bonds feature ‘call dates’ which means that there is a specific date or dates on which the bond issuer can repay the bond holders prior to the maturity date. This ‘call provision’ is a right but not an obligation and complicates the process of comparing the potential returns of callable bonds and vanilla bonds.

The bond issuer will only choose to repay the bond at the call date if it is in their interests to do so. For example, if lower interest rates would be available when issuing a new bond.

In order to compare a callable bond with a standard vanilla bond, you can calculate ‘yield to call’ (YTC) which calculates the expected yield based on the assumption that the bond is recalled by the bond issuer at the call date.

Yield to call calculation

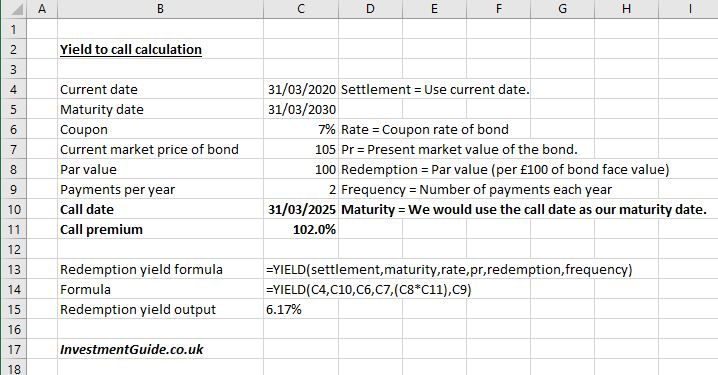

Again, whilst it is possible to calculate yield to call manually, it is far easier to calculate using Excel.

In order to calculate yield-to-call, we need two additional inputs:

- Call date – For this example, we will assume that our bond has a call date in 5 years time (31/03/2025).

- Call premium – Often, the call provision allows the bond issuer to repay the bond at a premium to the bonds par value. In this example, we assume a call premium of 2.0% (i.e. call value of £1,020), so we enter 102.0%. If the bond is callable at par, then there is no need to refer to a call premium.

When we have input these values, we follow the exact same steps as used when calculating redemption premium. The only changes are to:

- Maturity = Amend the maturity date to now reference the call date of 31/03/2025

- Redemption = Amend the redemption to reflect any call premium. In this example, we did this by multiplying cell C8 (1,000 par value) by cell C11 (102.0% call premium).

The yield to call for this bond is 6.17%, which is lower than the redemption yield in our example. If the bond is redeemed at a premium to par value at the call date in five years time, we would only benefit from five more years of the 7% coupon rate.

In practice, callable bonds typically offer higher yields than non-callable bonds. This is because the bond issuer could decide to repay the bond if interest rates fall, resulting in the bond holder having to reinvest capital elsewhere at potentially lower interest rates. This represents an advantage to the issuer as they can refinance the bond to benefit from lower interest rates.

Yield to worst

In order to determine yield to worst, you must first calculate both the redemption yield (or ‘yield to maturity’) and the yield to call. This is because ‘yield to worst’ refers to the worst possible yield which an investor can receive from a callable bond without considering without defaulting. If a bond is not callable, the yield to worst is the same as the redemption yield.

Yield to worst is useful as there is little point in an investor considering the redemption yield on a callable bond if it is highly likely that the bond will be repaid at the call date and the yield to call is lower.

To determine the ‘yield to worst’, you simply calculate both redemption yield and yield to call and take the worst yield percentage out of the two.

Potential bond returns should be compared using yield to worst. This is because yield to worst represents the worst possible return an investor could receive from a bond, providing the bond is repaid.