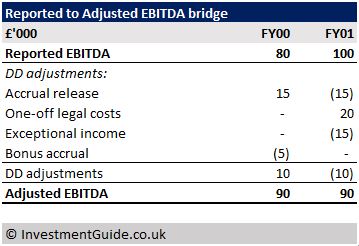

Adjusted EBITDA is calculated by taking Reported EBITDA and adjusting for any one-off or exceptional items. It is commonly used in acquisitions with enterprise value (headline price) often based on a multiple of Adjusted EBITDA.

The multiple of Adjusted EBITDA paid can vary significantly depending on the desirability of the target company and the sector in which it operates. For example, many technology companies can be subject to offers in excess of 30x Adjusted EBITDA, whereas perhaps a plumbing services business might attract a multiple of 8x.

Given buyers pay based on a multiple, fairly small EBITDA adjustments can have a not insignificant impact on the headline price.

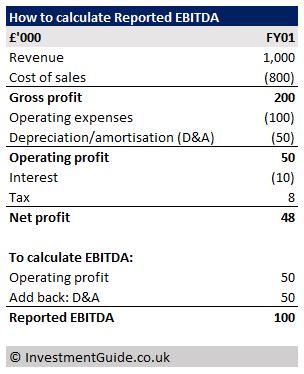

So, before we jump into the detail, let talk about what EBITDA represents. EBITDA is earnings before interest, depreciation and amortisation. It is commonly used in transactions as a good proxy for the cash flow that a company generates. This is because depreciation/amortisation are non-cash items and sensitive to policy adopted, interest is dependent on the financing structure of the company and tax charges depends on a number of factors (e.g. structure adopted, losses carried forward, deferred tax, changes in tax law).

To calculate EBITDA, you simply take operating profit (or ‘EBIT’) and add back depreciation and amortisation. If you start at net profit, you need to add back depreciation and amortisation, along with interest and tax. Most companies will track EBITDA as part of their monthly management accounts.

In order to calculate Adjusted EBITDA, you start with Reported EBITDA and adjust in order to illustrate the true underlying profitability of the business. These adjustments are intended to strip out any one-off/exceptional items which are unrepresentative of the business going forwards.

Types of EBITDA adjustments

EBITDA adjustments normally fall into one of two categories: (1) normalisation adjustments, and (2) pro-forma adjustments.

Normalisation adjustments adjust actual historical performance, stripping out items that are deemed not to represent the company’s underlying performance. For example, the removal of non-recurring/one-off items, adjustments to consider accounting changes or estimates, or realignment of expenses into the appropriate period (e.g. in the case of an accrual created and ultimately released after not being used in the following period). Adjustments should not be made for changes which happen in the normal course of business. For example, normal fluctuation in regulatory costs incurred, or a permanent price increase of a particular product line.

The key question you should ask yourself, particularly when looking at the latest years results, is ‘should I pay a multiple/give value for this EBITDA’. If the answer is no, an adjustment is likely to be required. Judgement should be applied given there is no fixed definition of ‘Adjusted EBITDA’.

Pro-forma adjustments are illustrative adjustments in the current or prior periods to reflect the current structure of a business. The most common pro-forma adjustment would be to reflect the trading results of an acquired entity. For example, if an entity was acquired during mid-FY20, you would have a pro-forma adjustment in FY20 for half the years trading and a full year adjustment in FY18 and FY19. The aim of pro-forma adjustments is to show the historical results of the business on a like-for-like basis. If you don’t make a pro-forma adjustment for an acquisition, growth might be misconstrued as organic growth.

Similarly, a pro-forma adjustment would be made in the case of a disposal. In this case, the EBITDA of the disposed entity would be excluded.

Other examples where pro-forma adjustments might be required include:

- New customer win or customer churn. This may require assumptions to be made as companies often do not track profitability by customer.

- Foreign exchange changes i.e. attempting to show EBITDA on a constant currency basis where there have been significant foreign exchange rate changes.

- Manufacturing plant closures.

- Restructuring cost savings (e.g. where a large cost saving program has been implemented).

- Minimum wage increases where this has had a significant impact on the cost base in a particular year (may just be an ‘other item to consider’ rather than a pro-forma adjustment)

Note that we typically not propose a pro-forma adjustment for items such as changes in selling prices, raw material prices or normal increases in payroll. The example above where minimum wage increases are introduced was suggested based on this being an event forced by legislation.

Now that you understand the key types of EBITDA adjustments, the below is a long list of quite common EBITDA adjustments that are seen in financial due diligence reports.

Common EBITDA adjustments

- Out of period revenue/costs – For example, items which are accrued/provided for in one period, but then released to the P&L in the following period. This is a common method to inflate EBITDA and Finance Directors will quite often attempt to hold excess provisions/accruals such that they have a means by which to manage P&L performance if required.

- Severance/restructuring/redundancy costs – Where there has been a material level of redundancy costs incurred, these would be regarded as exceptional. Where the costs are incurred in the normal course of business (i.e. a single redundancy) these would not be regarded as exceptional.

- Bad debt release/normalise bad debt expense – For example, where a business which typically has no bad debt recognises a large bad debt expense in one period. It may be deemed appropriate to normalise the expense recognised.

- Significant litigation costs/pay-outs – If a large expense is recognised in relation to legal expenditure which does not form part of normal trading, this would likely be adjusted as an exceptional item.

- One-off insurance receipts (consider against related loss the claim is recovering).

- Significant levels of non-recurring revenue. For example, where the company has had much higher revenue than would normally be expected. The required adjustment would be the EBITDA impact of this peak in trade. This is a fairly judgemental adjustment which Management are likely to push back on.

- 52/53-week accounting period – Where the business has a 52/53 week accounting period (i.e. it segments the year into 4/5 week blocks rather than calendar months), you need to strip out the EBITDA impact of the 53rd week in the year which this impacts.

- Transaction related professional fees or other one-off professional fees. These are not trading in nature and thus are adjusted.

- Profit/loss on disposal of fixed assets. Selling your fixed assets is not typically part of normal trading (otherwise those assets would be held as stock and not fixed assets) and thus should be presented below the line.

- Any personal expenditure included in EBITDA. This is common in owner managed businesses where family members are on the payroll but not performing an active role.

- Like-for-like adjustment to reflect constant application of accounting policy (e.g. where revenue recognition policy has changed throughout the historical period).

- Bonus – Where the expense recognised does not match the bonus ultimately paid in respect of a particular year, an adjustment is required to align the expense to the appropriate period.

- Unusual or non-recurring incentive compensation (e.g. a large one-off bonus award).

- Claims/rebates recognised in the incorrect accounting period.

- Any proposed but unadjusted audit adjustments. These are found by looking at the audit memorandum.

- Any audit adjustments posted through reserves as they relate to the prior period. These can be identified by creating a reserves rollforward.

- Any large post year-end refunds which relate to the prior year? An adjustment could be made to reallocate these to the period to which they relate.

- Rent-free or discounted rent periods – The rent-free period should be properly accounted for. Typically, we would look to ensure that this has been properly accounted and that the remaining rent-free period should be treated as a net debt adjustment.

Items which are commonly not adjusted for, but often cited as ‘other considerations’

- Standalone costs (consideration of the new cost base post-deal e.g. potential reduction in purchasing power where a business is being carved out from a larger organisation) / post-transaction synergies – The work involved in identifying standalone costs and post-transaction synergies is usually performed by an entirely separate workstream within professional advisory firms. These are forward looking pro-forma type adjustments rather than historical normalisation adjustments given that there is an element of judgement involved.

- Monitoring fees – The new owners will have their own monitoring arrangements and the fees charged may vary. As such, monitoring fees are commonly called out for awareness but not adjusted.

- Capitalised development costs – Within software businesses which capitalise the time their R&D staff spend on development, a significant proportion of staff costs are capitalised. These costs represent a cash cost to the firm. As such, commonly capitalised development costs will be deducted from Adjusted EBITDA to arrive at an ‘Adjusted Cash EBITDA’ or will simply be called out as a memo line so that potential acquirers are aware of the cost levels.

- R&D tax credit – Where an R&D tax credit is recognised above the line, these are either adjusted out (where not expected to continue) or called out as an ‘other consideration’ so that the potential acquirer is aware of the level of EBITDA derived from R&D tax credits.

Identifying EBITDA adjustments

EBITDA adjustments are identified throughout the course of a financial due diligence project. Aside from Management discussion, EBITDA adjustments are often found through the following types of analysis:

- Looking at items included in the P&L below EBITDA. For example, Management may have classified items as ‘exceptional’ and recorded below EBITDA, when they are not truly exceptional.

- Analysis of key balance sheet accounts such as accruals, prepayments, other creditors, and other debtors. Discussing with Management whether there have been any releases to the P&L across the period under review.

- Detailed cost base review – you can look at monthly trends to identify peaks/troughs in expenditure. These will often indicate the existence of one-off items. Similarly, you could look at TB level data if available. The detailed descriptions on TB codes may help to identify one-off items.

- Reserves rollforward – by performing a reserve roll-forward, you can identify where adjustments have been posted to retained earnings which relate to prior periods. Where such adjustments relate to items impacting EBITDA which are not exceptional, an adjustment should be made.

- Board minutes – reading board minutes can help to identify one-off items discussed at a board level.