Accrued revenue arises because of the accruals basis of accounting, which states that revenue should be recorded in the profit and loss across the period to which is relates.

Where revenue should be recognised but the customer has not yet been billed, accrued revenue arises. The most common example of where accrued revenue might arise would be when providing professional services to a customer, where milestone billing in arrears has been agreed.

Accrued revenue is a contract asset. This is because it represents the value of the goods/services that you have already delivered to a customer. It is the value you expect to invoice the customer for those goods/services.

Accrued revenue example – accounting double entry

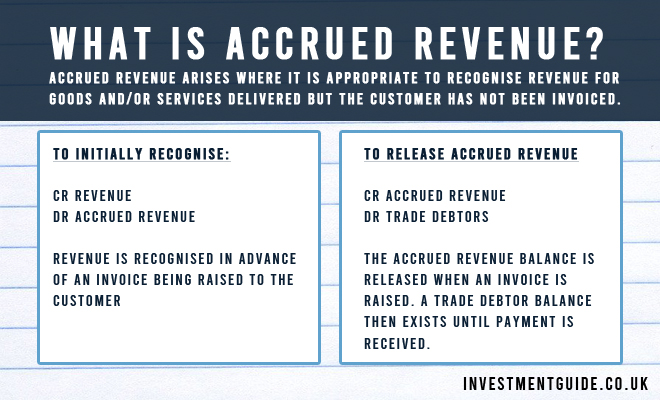

To recognise accrued revenue, the accounting double entry is Cr Revenue, Dr Accrued Revenue.

When it is then time to invoice the customer, the accounting double entry is Dr Trade Debtors, Cr Accrued Revenue. When cash is then received, the posting would be Dr Cash, Cr Trade Debtors.

Key risks associated with accrued revenue

There are two key risks which must be considered when conducting due diligence over accrued revenue:

- The non-recoverability of balances recognised as revenue but not billed.

- For example, where revenue has been recognised for professional services delivered to a customer, but the customer has raised concerns with the quality of the services provided. In this instance, the business may struggle to recover the full value of the accrued revenue and may need to issue a credit note to keep their customer happy.

- Inappropriate recognition of accrued revenue (i.e. where accrued revenue should not have been recognised). This can be identified by talking through each of the larger accrued revenue balances and discussing with Management what they relate to and why they felt it was appropriate to recognise the accrued revenue.

Typical accrued revenue analysis

When performing due diligence on a business, there are a few different ways you would typically seek to analyse accrued revenue.

- Create a schedule of accrued revenue by age

- Once you have a schedule of accrued income by age, this can be used to query why certain aged balances have not yet been billed. This analysis can help to identify accrued revenue balances which perhaps shouldn’t have been recognised and which may not ultimately be recoverable. If you obtain a breakdown of accrued revenue for a particular month-end, it is useful to ask for a post-date view of what has subsequently been billed.

- Obtain a breakdown of accrued revenue by revenue type

- Creating a breakdown of accrued revenue by revenue type allows you to confirm your understanding of which types of revenue are typically billed in arrears.

- Obtain a breakdown of accrued revenue by customer

- Creating a breakdown of accrued revenue by customer allows you to gain an understanding of which customers are billed in arrears.