With house prices in the UK continuing to spiral upwards, many more buyers, particularly first time buyers, are opting to take longer mortgage terms of 30/35 years. But does taking a 30 or 35 year mortgage term over a 25 year mortgage term make sense financially?

There isn’t a simple yes or no answer to this question.

Stating the obvious, if you get a longer term mortgage, your capital repayments are lower as you are repaying the capital over a longer time period.

Interest payments are higher as (i) the outstanding capital is not paid down as fast, and (ii) you will be paying interest for 30/35 years rather than 25 years.

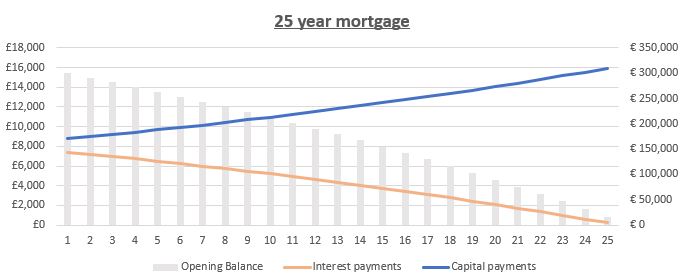

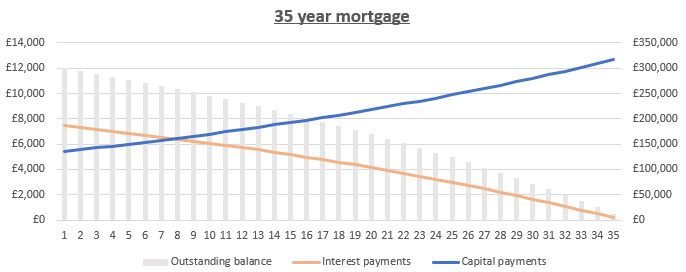

Towards the start of a capital repayment mortgage, more of the monthly payment is used towards interest than capital repayment. Over time though, as more repayments are made on the mortgage, the capital balance decreases faster.

25 year mortgage

35 year mortgage

Comparing a 25 year mortgage to a 35 year mortgage

Let’s imagine a mortgage of £300,000 with a 2.5% interest rate. In the first year, you will pay:

- 25 year mortgage: £8,750 in capital repayment, £7,400 in interest, totalling £16,150.

- 30 year mortgage: £6,802 in capital repayment, £7,422 in interest, totalling £14,224.

- 35 year mortgage: £5,432 in capital repayment, £7,438 in interest, totalling £12,870.

By year 10 of the respective loans, you would be paying:

- 25 year mortgage: £10,955 in capital repayment, £5,195 in interest, totalling £16,150. You would have repaid £98,180 of capital after year 10, and would have paid £63,342 interest.

- 30 year mortgage: £8,516 in capital repayment, £5,708 in interest, totalling £14,224. You would have repaid £76,306 of capital after year 10, and would have paid £65,937 interest.

- 35 year mortgage: £6,801 in capital repayment, £6,069 in interest, totalling £12,870. You would have repaid £60,934 of capital after year 10, and would have paid £67,763 interest.

This example clearly shows that, assuming you are not doing anything else useful with the money, it is better to pay off your mortgage over a shorter term to avoid paying more interest charges than necessary.

For this reason, the mainstream media has been quick to sensationalise the existence and increased adoption of these longer mortgage terms. However, this simplistic view ignores two key factors.

Capital may be better deployed elsewhere

Property owners may choose to invest the funds that they are not paying towards the shorter term mortgage, putting them in a better financial position if strong returns are obtained.

In the example above, there is an £3,280 difference in total payment across the first year of the mortgage, of which £3,318 relates to capital repayment. There is just a £38 difference in interest payment.

Theoretically, if you invested that £3,318 in the stock market (£276.50 monthly, to align with the timing of mortgage payments) and were able to generate a return of 8%, then at the end of the year you would be left with £3,442 (£124 growth).

This means that you would be better off financially than if you had taken the 25 year mortgage term.

However, to present a balanced view, this does involve investment risk (positive returns are not guaranteed) and does require commitment to actually proactively invest the funds.

Longer mortgage terms which allow over payments can provide increased flexibility

Many mortgages allow you to overpay by up to 10% of remaining capital without incurring any fees.

You could therefore in theory take a 30 or 35 year mortgage, and simply make over-payments each month such that the mortgage features an identical repayment profile to that of a 25 year mortgage term.

However, taking this approach allows property owners to retain increased flexibility in their spending. For instance, it would be easy to forgo an overpayment in a month where something unexpected has gone wrong with his/her motor vehicle.